- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Microfinance in India

Microfinance in India

17-11-2023

Context

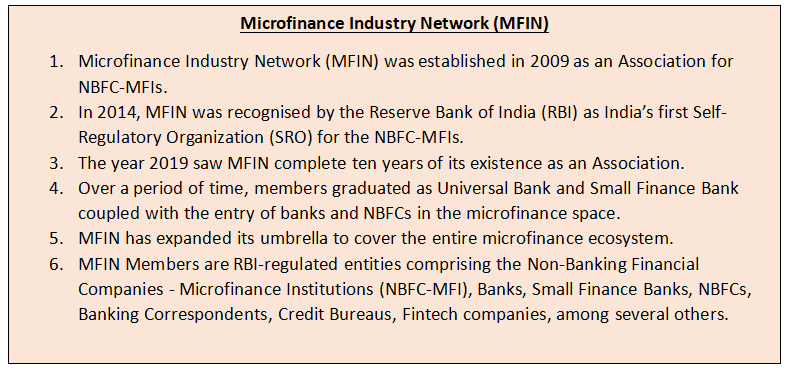

The Microfinance Industry Network (MFIN) recently held its third edition of "Micro Matters: Macro View – India Microfinance Review FY 2022-23" in Mumbai.

Key findings of the report

- The microfinance sector has expanded to 87 lakh new women clients, reaching approximately 6 crore low-income women with outstanding credit of over 3 lakh crores across 729 districts.

- MFIs followed by banks are the largest provider of micro-credit amongst other regulated entities.

- MFIs' gross Non-Performing Assets (NPA) decreased from approximately 5.6% in FY22 to 2.7% in FY23.

About Microfinance in India

- Status: A National Council of Applied Economic Research (NCAER) study indicates that microfinance contributes to approximately 130 lakh jobs and 2% of the Gross Value Added (GVA).

- Microfinance: RBI defines microfinance as collateral-free loans to households with annual income up to Rs.3 lakh.

-

Significance of Microfinance in India:

- Boosting Entrepreneurship: MFIs offer small loans, promoting entrepreneurship and business development, which in turn leads to economic growth and job creation.

- Financial Inclusion: MFIs promote financial inclusion by offering credit and services to those excluded from traditional banking, enabling savings, education, healthcare investment, and entrepreneurship.

- Poverty Reduction: Microfinance is a financial system that provides small loans to the poor, thereby reducing poverty and enhancing their standard of living.

- Empowering Women: Microfinance significantly empowers women by providing financial resources, promoting economic independence, and enhancing their social standing.

- Supporting Rural Development: MFIs aid rural development by offering small loans to farmers and entrepreneurs, thereby boosting agricultural productivity and contributing to economic growth in rural areas.

- Challenges with Microfinance in India: The issue of over-indebtedness, high interest rates, lack of financial literacy, operating in remote areas with inadequate infrastructure, political interference, and lack of regulation are significant challenges.

Government Initiatives for Microfinance in India

- SHG-Bank Linkage Program: The goal is to boost the loan volume of Self-Help Groups (SHGs) and shift their money lending from non-income-generating activities to production-based ones.

- E-shakti Programme: The goal is to digitize the accounts of various SHGs and ensure their members are included in the Financial Inclusion program.

- PM SVANidhi: a special micro-credit loan facility providing affordable working capital loans to street vendors.

Way Forward

The focus is on enhancing the regulatory framework, enhancing financial literacy, fostering partnerships, and ensuring social impact