- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

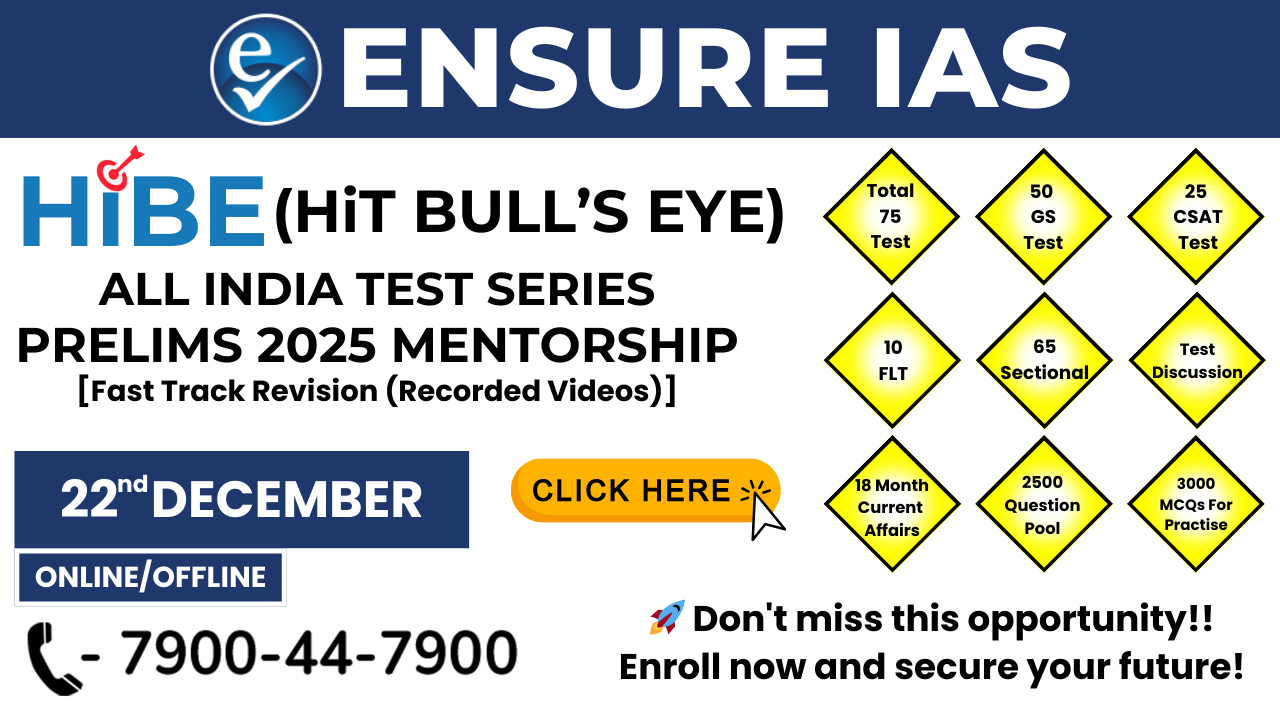

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

India’s Economic Outlook for 2025: Opportunities and Challenges Ahead

India’s Economic Outlook for 2025: Opportunities and Challenges Ahead

28-12-2024

- India’s economy is facing a mixed scenario in 2024.

- While the country remains one of the fastest-growing large economies, it also has both positive trends and serious challenges to manage.

- As India aims to maintain a 6.5% growth rate in the coming years, the key question is whether this growth will be enough to meet the country’s job creation needs and reduce growing wealth inequality.

I. India’s Economic Performance in 2024:

A. Economic Slowdown: Why Growth Has Slowed

- India’s economic growth in Q2 of FY25 was only 5.4%, lower than expected. This raises concerns about the country’s growth trajectory.

- Some economists predict the slowdown might continue in the third quarter of the year.

- Temporary Slowdown: Experts argue that this slowdown is just part of a normal cycle after the pandemic.

- During the pandemic, the economy grew unusually fast, but now it is returning to a more steady and sustainable growth path.

- Government Confidence: Finance Minister Nirmala Sitharaman and Chief Economic Adviser V Anantha Nageswaran believe that the economy will stabilize at around 6.5% growth in the next five years.

- They are confident this growth rate will keep India as one of the fastest-growing large economies.

II. Positive Factors for India’s Economic Growth

Despite challenges, India has several positive developments that could boost its growth in the coming years.

A. Government Spending and Fiscal Support

- Increased Government Spending: After the elections, the government is expected to increase spending, especially in sectors like infrastructure, public services, and development projects.

- This should help drive growth in the economy.

- Supportive Monetary Policies: The Reserve Bank of India (RBI) has made moves to help growth, such as reducing the cash reserve ratio (CRR).

- This has allowed banks to lend more money, which can help businesses and consumers. Also, lower interest rates are expected to support growth.

B. Recovery in Micro, Small, and Medium Enterprises (MSMEs)

- Around 39.6% of women with education level of post-graduate and above were reported as working in FY24, compared to 34.5% in FY18.

- For women with higher secondary education level, these numbers were 23.9% and 11.4%.

- Micro, Small, and Medium Enterprises (MSMEs), which are vital for job creation, have faced challenges like demonetization, GST implementation, and the COVID-19 lockdown.

- However, these businesses are starting to recover, especially in rural areas, where they are helping to create jobs and contribute to growth.

- More Jobs: There is an increase in non-casual jobs (stable jobs with regular pay) in MSMEs, particularly in rural areas.

- This is helping reduce unemployment and support more women joining the workforce.

C. Growth in India’s Services Sector

- Strong IT Exports: India’s IT sector continues to grow, particularly in software, business outsourcing, and other services.

- The country’s services exports (including IT and business services) are now larger than goods exports.

- This is a sign of India’s increasing importance in the global services economy.

- Remote Work Trend: Remote working and the growth of internet connections worldwide are benefiting India’s service sector.

- However, artificial intelligence (AI) and other technologies may pose challenges for the long-term growth of India’s IT exports.

III. Challenges Facing India’s Economy

Despite the positive trends, India faces several challenges that could limit its growth potential.

A. Sluggish Private Investment

- Lack of Confidence in the Private Sector: Even though the government has cut corporate taxes to encourage investment, private companies are still hesitant to invest.

- Many businesses are uncertain about the future and are concerned about India’s complicated tax system.

- Weak Demand: Major companies, such as Tata Consumer Products and Nestlé, have pointed out that consumer demand in cities is weak, especially for food and everyday goods.

- This slowdown in demand is a major concern for businesses and could harm growth.

B. Falling Household Savings

- Declining Savings: India’s savings rate is falling. In FY23, household savings dropped to 5.3% of GDP, a significant fall from 7.3% in FY22.

- This is a concern because savings help fuel investment, and less savings could hurt future growth.

- Rising Debt: At the same time, household debt (loans taken by families) has been increasing.

- Many families are borrowing more money for personal expenses and housing.

- If people can’t repay these loans, it could become a serious problem.

C. Slowdown in Credit Growth

- Falling Credit Growth: The growth in credit (loans from banks) has slowed down. Since people aren’t taking out as many home loans and personal loans, banks are less eager to lend money.

- Businesses are also borrowing less due to excess capacity (too many goods and services already being produced).

- Non-Performing Loans (NPLs): As lending slows, there are worries about an increase in bad loans, especially in the personal loan and credit card sectors.

- These loans are more risky, and if borrowers can’t repay, it could harm the economy.

D. Fiscal Challenges and Rising State Government Spending

- While the central government has been focused on reducing its budget deficit, many state governments are increasing their spending, especially on subsidies and welfare programs.

- This could put pressure on the country’s finances and lead to higher inflation.

- Food subsidies from the government have led to higher demand for essential items like pulses and vegetables.

- However, the supply of these goods has not been enough to meet demand, leading to increased food prices. This is raising costs for low-income families.

Conclusion: Looking Ahead

India’s economy is at a crucial stage. While the country is expected to maintain 6.5% growth in the coming years, it faces serious challenges in terms of job creation, inequality, and inflation. The government and businesses must focus on boosting private investment, improving the business environment, and ensuring inclusive growth for all sections of society.

|

Also Read |

|