- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- NCERT Medieval History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

IEA Released "India Gas Market Report: Outlook to 2030”

IEA Released "India Gas Market Report: Outlook to 2030”

Recent Context

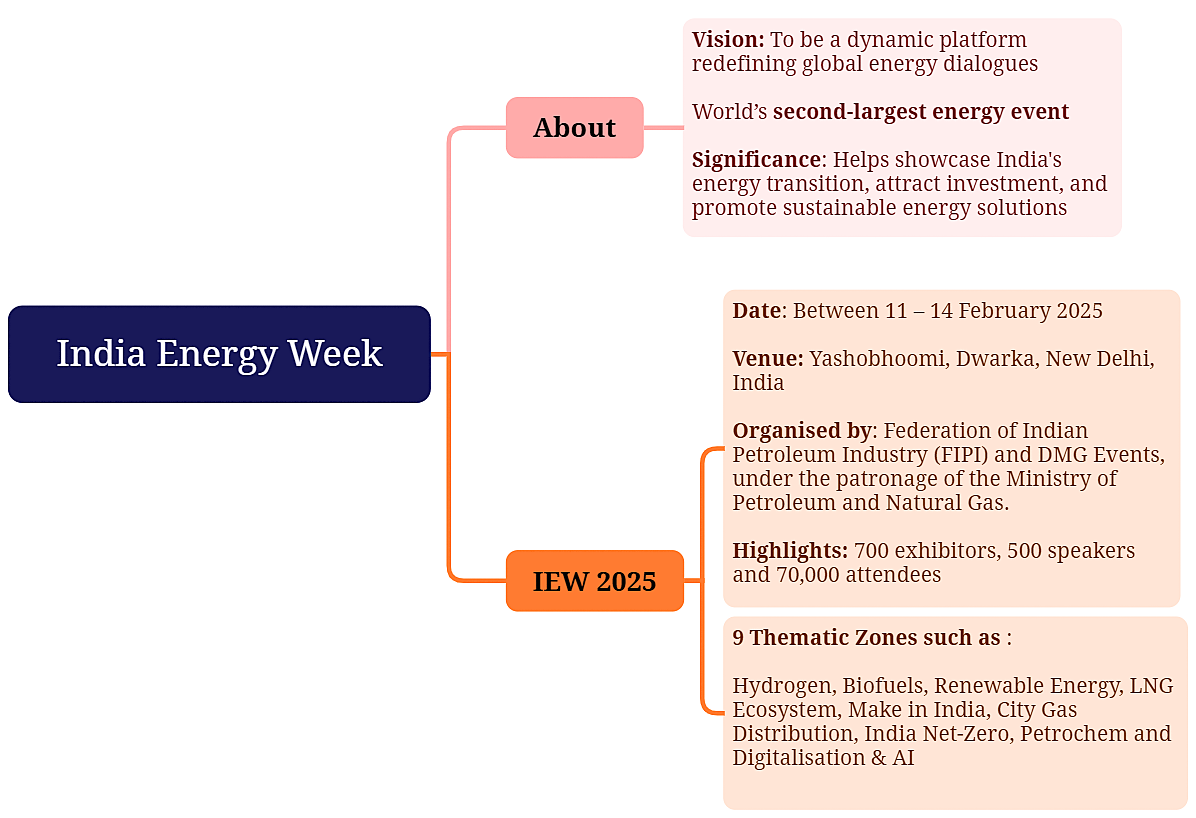

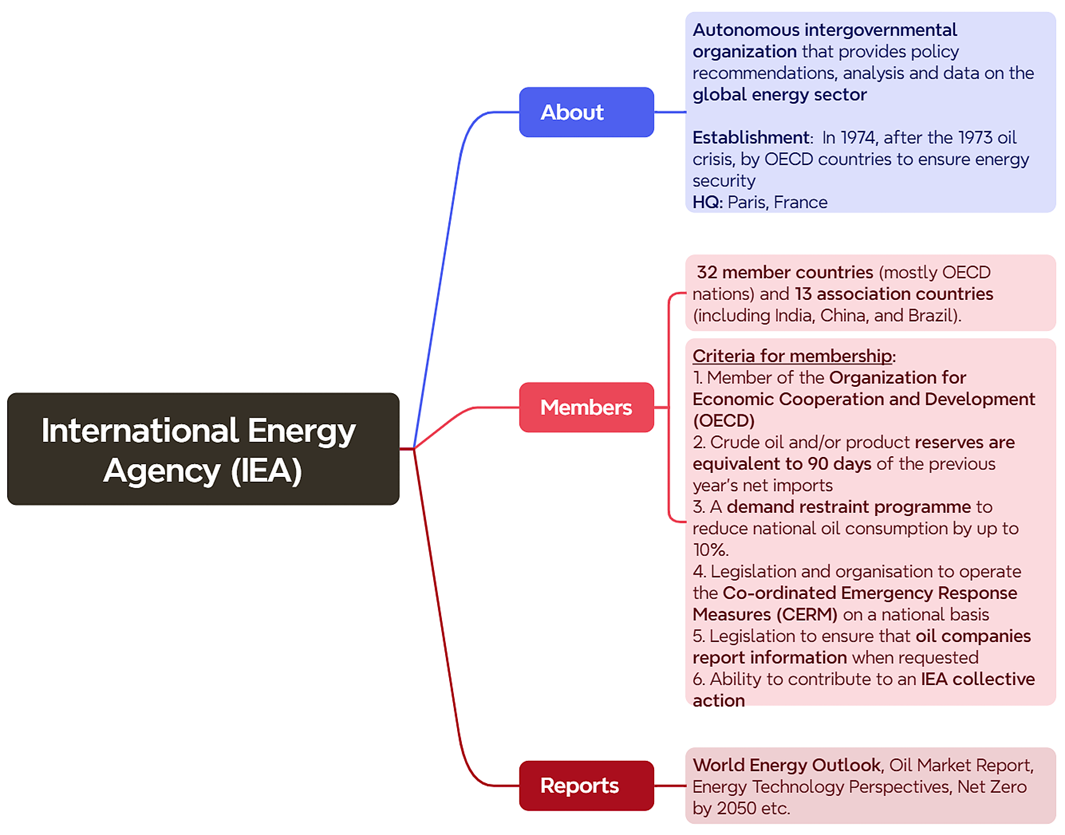

- The International Energy Agency released the “India Gas Market Report: Outlook to 2030” at the India Energy Week 2025 (February 11-14).

- The report noted that India's gas market is at an inflection point (point of change) as infrastructure expansion and policy support drive unprecedented growth in consumption.

- It projected India’s natural gas demand to increase by nearly 60% by 2030.

- This report is significant as India is also targeting to raise the share of relatively cleaner natural gas in its energy basket to 15% by 2030 from just above 6% currently.

Significance of Natural Gas

|

SIGNIFICANCE |

DESCRIPTION |

|

Energy Efficient |

Gondwana coal – 4500 kcal/kg; Natural Gas – 9000 kcal/kg |

|

Cleaner Fuel |

Lesser emissions and particulate matter. For instance, Compressed Natural Gas (CNG) is a cleaner alternative to diesel and petrol. |

|

Highly Flexible |

Can comply to power backdown instructions within 2 hours |

|

Economy of use |

Cheaper compared to petrol and diesel |

|

Supply chain convenience |

Can be supplied through pipelines. For example, HVJ (Hazira-Vijaipur-Jagdishpur) Pipeline. |

|

Diverse applications |

Used as a kitchen fuel, transport fuel and as a feedstock in production of chemicals such as fertilizers, and hydrogen (grey hydrogen). |

What is the potential of Natural Gas demand growth in India as per the report?

- Recent boost: India’s natural gas demand increased by more than 10% in both 2023 and 2024, indicating an inflection point.

- Future potential:

- The country’s gas consumption is set to reach 103 billion cubic meters (bcm) annually by 2030.

- With adequate interventions gas consumption could reach around 120 bcm/yr by 2030, close to the current gas consumption of South America.

- Key factors behind this potential:

- Rapid infrastructure expansion

|

Since 2019 |

|

|

2030 expectation |

|

-

- Recovering domestic production

- Expected easing of global gas market conditions.

- City gas distribution (CGD) sector is expected to lead consumption growth

- CGD refers to distribution networks to supply cleaner cooking fuel (like, PNG) to households, industrial & commercial units as well as transportation fuel (like, CNG) to vehicles.

- Aims to cover 407 districts and make gas accessible to over 70% of the population.

What are the challenges in India’s Natural Gas sector?

-

Huge import dependence:

- India is the fourth largest LNG (Liquified Natural Gas) importer in the world.

- Between 2013 and 2023, India’s LNG imports increased by 70%, and reached 36 bcm in 2024.

-

Limitations in domestic gas production:

- Due to this the report says that India’s LNG imports will need to more than double to around 65 bcm annually by 2030 to meet rising demand.

-

Domination of state gas utility GAIL (Gas Authority of India Limited):

- GAIL owns most of the pipelines transmitting gas and is also the biggest seller of gas.

- This can create conflicts of interests where the company prioritises its own interests over other parties.

What are the suggestions offered by the report?

-

Gas pricing freedom:

- Gradually extending gas pricing freedom to all fields, as recommended by the Kirit Parekh Committee in 2022, could stimulate greater investment and improve the long-term availability of gas for India's consumers.

- A phased approach is needed to protect consumers from price volatility.

- Lifting the price ceiling on deepwater and ultra-deepwater high pressure/high temperature projects

-

Free sale on Indian Gas Exchange (IGX)

- Allowing sale of a larger portion of domestic production freely on the IGX allows better price discovery.

- Independent gas transmission system operators (TSOs) to ensure fair, transparent and non-discriminatory access to gas infrastructure.

- Legal separation of transport of gas from marketing and sales operations to enhance market competition, increase flexibility, and improve infrastructure utilisation.

- Standardisation of gas sales agreements (GSAs) and gas transmission agreements (GTAs) across India

-

Adjustment of tax structure:

- A favourable tax structure to support the use of gas as a transport fuel, could encourage its adoption and reduce emissions compared to diesel and petrol vehicles.

- For instance, rationalising the GST on compressed natural gas (CNG) vehicles.

-

Other targeted policy measures needed:

- Faster adoption of LNG in heavy-duty transport

- More rapid expansion of city gas infrastructure

- Boost utilization of gas-fired power plants

Conclusion

India’s natural gas market is thus poised for unprecedented growth. Thus, to meet this potential, there is a need for strategic initiatives and policy interventions. This must include strengthening domestic production, enhancing pipeline connectivity, and promoting natural gas in industries and households. This can ensure that India achieves its potential of being a ‘gas-based economy'.

|

Also Read |

|