Context

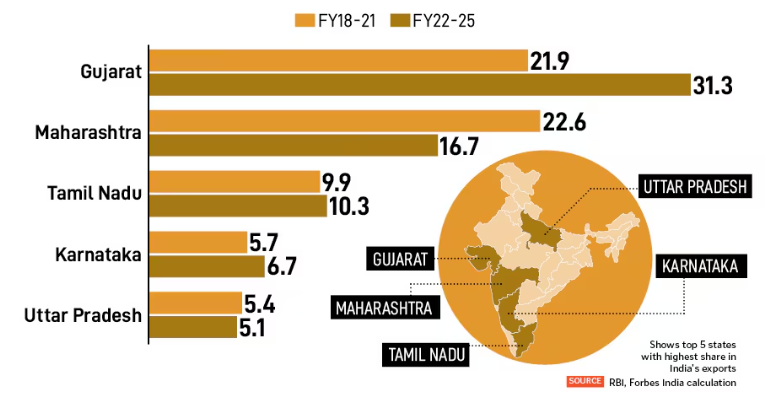

Recent export data shows that despite India’s impressive overall export performance, exports are increasingly concentrated in a few States. Analysis based on the Reserve Bank of India Handbook of Statistics on Indian States (2024-25) highlights growing regional inequality, capital-intensive growth, and weak employment absorption.

What is Export Concentration?

- Export concentration refers to a situation where a small number of regions or States dominate national exports.

- In India, the top five States – Maharashtra, Gujarat, Tamil Nadu, Karnataka, and Uttar Pradesh – account for nearly 70% of total exports.

- Five years ago, these States contributed about 65%, showing rising concentration over time.

- This trend reflects a core-periphery pattern, where developed coastal States form the “core” and large hinterland States remain the “periphery”.

- The Herfindahl-Hirschman Index (HHI), a measure of concentration, shows that India’s export geography is becoming increasingly top-heavy.

| The Herfindahl-Hirschman Index (HHI) 1. It is a way to measure how much something is concentrated in a few hands. 2. A higher HHI value means that fewer States control a larger share of exports. 3. In India, the HHI of exports is rising, which means exports are becoming more concentrated in a small number of States. 4. This shows that export growth is not spreading evenly, but becoming top-heavy, with most States contributing very little. |

Why is Export Concentration Rising?

- Global trade growth is slowing: World Trade Organization data shows merchandise trade growth now remains in the 5-3% range.

- UN Trade and Development (UNCTAD) estimates that the top 10 exporting countries control about 55% of world trade, limiting space for late entrants.

- Global investors now prefer countries and regions with advanced industries, skilled workers, and strong supply chains, rather than just places that offer cheap labour.

- Regions with diverse and interconnected industries can upgrade to high-value exports, while others remain stuck in low-complexity products.

- India’s hinterland States lack the industrial ecosystem, logistics precision, and skilled workforce required for complex exports.

How the Nature of Exports Has Changed?

- Shift from Labour to Capital

- Export growth no longer guarantees mass employment.

- Annual Survey of Industries 2022-23 data shows:

- Fixed capital investment grew by 10.6%

- Employment grew by only 7.4%

- Fixed capital per worker has risen to ₹23.6 lakh, showing strong capital deepening.

- Weak Employment Absorption

- Periodic Labour Force Survey data shows manufacturing employment stuck at 6%-12% despite rising exports.

- This means the employment elasticity of exports has fallen sharply.

- Export growth is creating value without jobs, especially bypassing labour-intensive industrialisation.

- Spatial Lock-in of High-Tech Exports

- Electronics exports under the PLI scheme grew by over 47% year-on-year, but remain confined to specific districts like Kancheepuram and Noida.

- These regions benefit from dense supply chains and logistics, which are absent in most hinterland States.

Implications

- Export growth no longer acts as a pathway to development, but rather reflects existing industrial capacity.

- Rich States export more because they are already developed, while poorer States remain excluded.

- Capital-intensive growth increases inequality, as productivity gains accrue more to capital owners than workers.

- Regional imbalance deepens as coastal States integrate into global supply chains while the hinterland decouples.

- Export numbers alone no longer indicate inclusive economic progress.

Challenges and Way Forward

| Challenges | Way Forward |

| High export concentration in a few States | Promote region-specific industrial ecosystems in lagging States |

| Capital-intensive exports generating few jobs | Encourage labour-absorbing manufacturing and MSMEs |

| Weak financial depth in hinterland States | Improve Credit-Deposit ratios through local investment incentives |

| Poor logistics and supply-chain connectivity | Invest in transport, warehousing, and industrial corridors |

| Human capital deficits in low-export States | Strengthen education, skilling, and health infrastructure |

| Export growth used as proxy for inclusive development | Use employment, wage share, and regional convergence as policy metrics |

Conclusion

India’s export growth increasingly reflects past industrial advantages rather than inclusive transformation. Re-aligning trade and industrial policy toward regional balance, job creation, and human capital development is essential for sustainable and equitable growth.

| Ensure IAS Mains Question Q. Exports were once viewed as a bridge from agriculture to mass industrial employment. Why has this link weakened in India? Discuss the regional and employment implications of export concentration. (250 words) |

| Ensure IAS Prelims Question Q. Consider the following statements regarding India’s export pattern: 1. The top five exporting States account for nearly 70% of India’s exports. 2. Rising export values in India have led to a proportionate increase in manufacturing employment. 3. Capital deepening refers to an increase in fixed capital per worker. Which of the statements are correct? a) 1 and 3 only b) 1 and 2 only c) 2 and 3 only d) 1, 2 and 3 Answer: a) 1 and 3 only Explanation Statement 1 is correct: Export data shows that five States dominate nearly 70% of India’s exports. Statement 2 is incorrect: Manufacturing employment has stagnated around 11.6%-12% despite rising exports. Statement 3 is correct: Capital deepening means higher fixed capital investment per worker. |

Also Read | |

| UPSC Foundation Course | UPSC Daily Current Affairs |

| UPSC Monthly Magazine | CSAT Foundation Course |

| Free MCQs for UPSC Prelims | UPSC Test Series |

| Best IAS Coaching in Delhi | Our Booklist |