- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Government Budgeting

Government Budgeting

10-03-2023

Government Budgeting

What is a budget?

- A government's budget is a summary of the item-by-item intended/expected revenues and anticipated expenditures for a given fiscal year.

- In India, the fiscal year lasts for two calendar years, beginning April 1 and ending March 31. The budget is created by government at every level, whether central, state, or local. The budget is made with the general government's policy toward the welfare of the people in mind.

Constitutional Provisions related to Indian Budget

- The Annual Financial Statement (AFS) is the name given to the Union Budget each year by Article 112 of the Indian Constitution.

- It is a statement of the estimated government spending and receipts for a given fiscal year, which begins on April 1 and ends on March 31 of the following year. The Budget also includes the following:

- The economic and financial policy for the upcoming year, including taxation proposals, prospects for revenue, spending program, and the introduction of new schemes or projects, estimates of revenue and capital receipts, methods and means to raise revenue, estimates of expenditure, details of the actual receipts and expenditures of the previous financial year, as well as the reasons for any deficit or surplus in that year.

The Budget goes through six stages in Parliament:

- Budget presentation.

- Talk about everything.

- Departmental Committees' scrutiny

- Voting on Grant Demands.

- The approval of the budget bill.

- The Finance Bill's passage.

The primary organization in charge of preparing the budget is the Budget Division of the Department of Economic Affairs in the Finance Ministry.

Goals of the Government Budget

- Reallocation of Resources: This helps to distribute resources in accordance with the country's social and economic conditions. In order to bring about economic equality, the government imposes taxes on the wealthy and spends the money collected on the welfare of the poor in order to reduce income and wealth disparities.

- Contributing to Economic Growth: The rate of investment and savings in a nation determines its economic growth. As a result, the budgetary plan focuses on accumulating sufficient resources for public sector investments and increasing the overall rate of savings and investments.

- Stabilizing the Economy: To achieve the goal of financial stability, the Budget focuses on avoiding business fluctuations. The economy's prices can be balanced with the help of Deficit Budget (in deflation) and Surplus Budget (in inflation) policies.

- Managing Public Enterprises: Numerous public sector businesses are designed to improve people's social well-being. The Budget is intended to provide various operating and financial assistance provisions for such businesses. By encouraging the installation of production facilities in underdeveloped regions, it aims to reduce regional disparities.

Components Of Budget

There are two major components of a budget.

Revenue budget

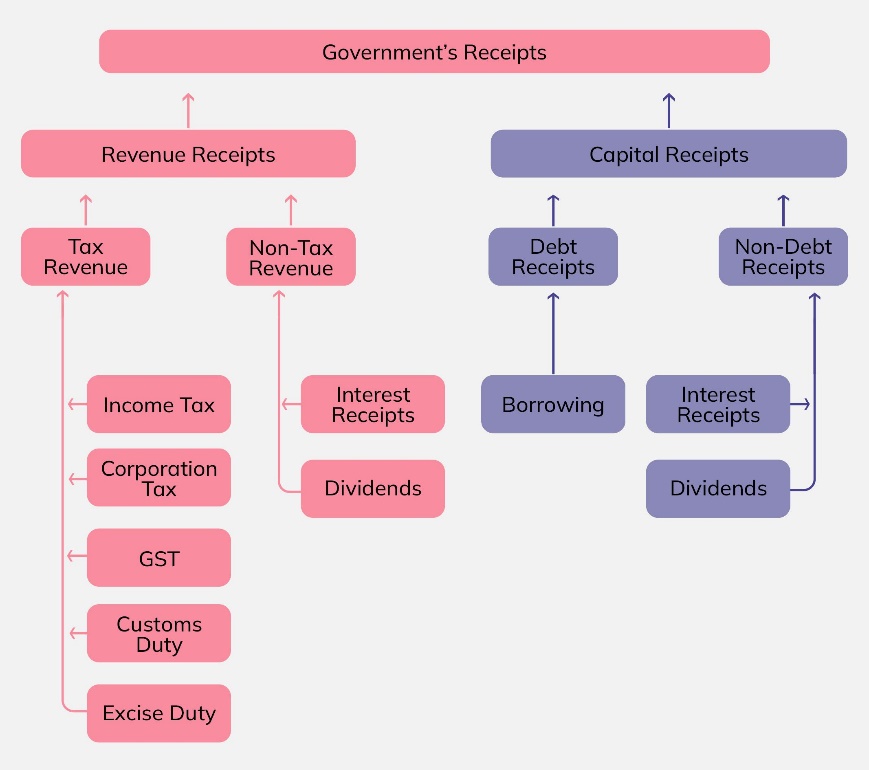

- The Revenue Budget is made up of two parts: the Revenue Expenditure and the Revenue Receipts.

- Revenue receipts are receipts that have no direct effect on the government's assets or liabilities. It is made up of money the government gets from taxes like excise duty and income tax as well as money that doesn't come from taxes like dividends, profits, and interest.

- The government's expenditures that have no effect on its assets or liabilities are known as revenue expenditures. Salaries, interest payments, pensions, and administrative costs are just a few examples.

Capital budget

- The capital receipts and expenditures are included in the capital budget.

- Capital Receipts indicate the receipts that cause the government's assets to decrease or its liabilities to rise. It is made up of: i) the money made by selling assets (or disinvesting), like shares in public companies, and ii) the money made by states borrowing money or paying back loans.

- Asset creation or liability reduction are the outcomes of capital expenditure. It is made up of: i) the government's long-term investments in building assets like roads and hospitals, and ii) the money it gives to states in the form of loans or repayments for its borrowings.

Gender Budgeting

- Gender-based assessment of Budgets, incorporating a gender perspective at all levels of the budgetary process and restructuring revenues and expenditures in order to promote gender equality" is known as gender-budgeting.

- The government declares a sum to be spent on female empowerment, welfare, and development initiatives through the Gender Budget.

- Gender budgeting is a strategy used by governments to ensure that public funds are allocated in a way that promotes gender equality and women's empowerment. In India, gender budgeting was first introduced in 2005 as a part of the Union Budget.

- The objective of gender budgeting in India is to identify and address the gender-specific needs and priorities of women in different sectors. It aims to mainstream gender concerns in the budgeting process, ensuring that government programs and policies are responsive to the needs of women and promote gender equality.

- The gender budgeting process involves analyzing the budget allocations of various government departments and assessing how they impact women. It also involves conducting gender-based audits to identify areas where the government can allocate more resources to support women's empowerment.

- The government of India has taken several steps to promote gender budgeting over the years. In 2017, the Ministry of Women and Child Development launched a gender budget portal that provides information on gender budgeting initiatives at the central and state level. The portal also provides a database of gender budget statements, gender budget cells, and best practices in gender budgeting.

- Additionally, the government has mandated that all ministries and departments prepare gender budget statements as a part of their annual budgetary exercise. The statements provide details of the funds allocated for programs and schemes that benefit women and girls, as well as the impact of these programs on gender outcomes.

- Overall, gender budgeting is an important tool for promoting gender equality and women's empowerment in India. While progress has been made, there is still a need for greater awareness and implementation of gender budgeting across different sectors and levels of government.

Types of budgets

There are 3 types of budgets: Balanced, Surplus, and Deficit Budgets

- Balanced Budget: It is assumed that a government budget is balanced if the anticipated expenditures and receipts for a fiscal year are equal.

- Surplus Budget: A budget is considered to be surplus when the anticipated expenditures for a given business year exceed the anticipated revenues. When taxes are higher than expenses in this case, the Budget becomes surplus.

- Deficit Budgets: A budget is considered to be in deficit if spending exceeds revenue for a given year.

Measures of Government Deficit

There are a number of ways to measure government deficit, including the following:

- Revenue Shortfall: It's the difference between what the government spends on revenue and what it gets.

- The revenue deficit only includes transactions that have an effect on the government's current income and expenditures. Revenue expenditure minus revenue receipts.

- When the government has a revenue deficit, it means that it is not saving enough and is using the savings of other parts of the economy to pay for some of its spending.

- Fiscal Shortfall: It's the difference between what the government spends and what it gets back. This is equivalent to the annual amount of money the government must borrow. If more money is received than is spent, there is a surplus.

- Total expenditure minus (revenue receipts plus non-debt-creating capital receipts) is the fiscal deficit.

- It shows how much money the government needs to borrow from all sources.

- From a financial standpoint: Gross fiscal deficit is the sum of net domestic borrowing, RBI borrowing, and foreign borrowing. The gross fiscal deficit is an important factor in determining the stability of the economy and the public sector's financial health.

- The fiscal deficit less interest payments is the primary deficit. This demonstrates the gap between the government's requirements for spending and its receipts, excluding the cost of making interest payments on loans taken in previous years.

- Fiscal deficit minus interest payments is the primary deficit.

Fiscal Responsibility and Budget Management (FRBM) Act

- The Fiscal Responsibility and Budget Management (FRBM) Act was passed by the Indian Parliament in 2003 with the objective of promoting fiscal discipline and reducing India's fiscal deficit. The Act aimed to limit the central government's fiscal deficit to 3% of the Gross Domestic Product (GDP) and eliminate revenue deficits by 2008.

- Under the FRBM Act, the government of India is required to prepare a Medium-Term Fiscal Policy Statement, which outlines the government's fiscal policy objectives and priorities for the next three years.

- The Act also requires the government to table a Fiscal Responsibility and Budget Management Bill in Parliament every year, which includes a statement of fiscal policy, a macroeconomic framework statement, and a Medium-Term Expenditure Framework Statement.

- The FRBM Act also established an independent Fiscal Responsibility and Budget Management Review Committee to assess the government's progress towards meeting its fiscal targets and make recommendations for improvements.

- While the FRBM Act has helped improve India's fiscal discipline and reduce its fiscal deficit, it has also faced criticism for being too rigid and hampering the government's ability to respond to economic shocks and crises.

- In 2018, the government amended the FRBM Act to allow for greater flexibility in meeting fiscal targets during times of economic downturn.

- Overall, the FRBM Act is an important tool for promoting fiscal discipline and ensuring the sustainable management of public finances in India. However, there is a need for continued review and reform to ensure that the Act remains relevant and effective in the face of changing economic and fiscal realities.

Issues With the Budgeting Process in India

The budgeting process in India has faced several issues over the years, including:

- Lack of transparency: The budgeting process in India has been criticized for its lack of transparency, with limited opportunities for public participation and scrutiny. There is a need for greater openness and accountability in the budgeting process to ensure that public funds are allocated efficiently and effectively.

- Inadequate data and analysis: The budgeting process in India often lacks sufficient data and analysis, leading to poorly informed decision-making. There is a need for better data collection and analysis to support evidence-based budgeting and improve the quality of policy-making.

- Limited integration of state and local governments: The budgeting process in India is heavily centralized, with limited integration of state and local governments. This can lead to a mismatch between local needs and central priorities, as well as duplication of efforts and inefficient use of resources.

- Insufficient focus on outcomes: The budgeting process in India often focuses more on inputs and outputs rather than outcomes, leading to a lack of clarity about the impact of government programs and policies. There is a need for greater emphasis on measuring and evaluating outcomes to ensure that government spending is effective in achieving its intended objectives.

- Inadequate attention to long-term planning: The budgeting process in India often focuses on short-term priorities, with limited attention to long-term planning and strategic thinking. This can lead to a lack of coherence and continuity in government policies and programs, as well as missed opportunities for achieving sustainable and inclusive economic growth.

Reforms needed in Budgeting (as suggested by 2nd ARC)

- The estimates' assumptions must be based on facts. The reasons for the discrepancy between "estimates" and "actuals" need to be determined at the end of each year, and efforts need to be made to reduce it. Auditing these assumptions should also be done.

- Unrealistic budget estimates are produced by formulating the annual budget by combining information from various organizations, units, and agencies into a predetermined aggregate amount. Along with budgeting based on "analysis of trends," this method should be abandoned. This should be replaced with a "top-down" approach that specifies aggregate spending limits for each organization or agency.

- After careful consideration, the budget should not include schemes or projects. To avoid making token provisions and dispersing resources across a large number of projects or programs, strict adherence to the budgeting guidelines is required.

- It is necessary to put an end to the practice of announcing projects and plans on an ad hoc basis in budgets, on significant National Days, and when dignitaries and officials visit states. The annual plans or the mid-term evaluation may include projects or plans that are deemed absolutely essential.