- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

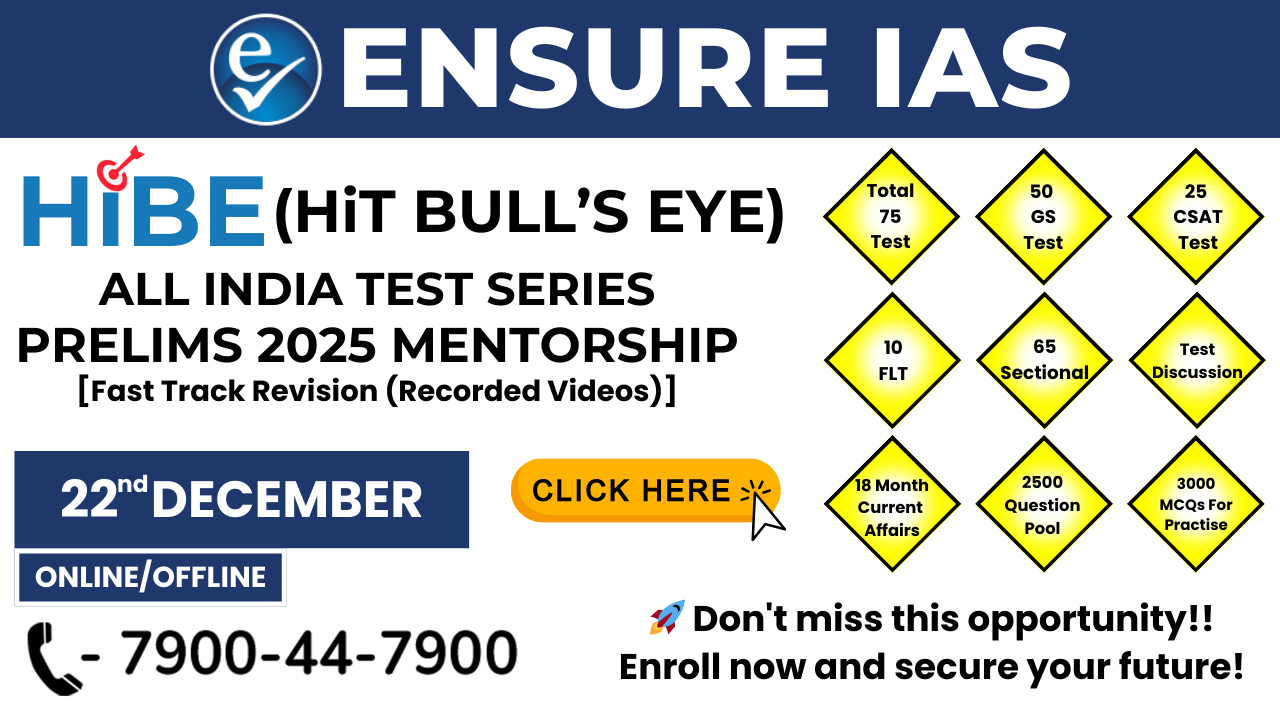

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

SEBI Changes Mutual Fund Rules to Introduce Specialised Investment Fund and Mutual Fund Lite

SEBI Changes Mutual Fund Rules to Introduce Specialised Investment Fund and Mutual Fund Lite

- The Securities and Exchange Board of India (SEBI) has made changes to its mutual fund rules, bringing in two important updates:

- launch of a new asset class called the Specialised Investment Fund (SIF)

- New rules for passively managed mutual fund schemes under Mutual Fund Lite (MF Lite).

- These changes aim to make investing easier and more flexible, especially for high-net-worth individuals (HNIs) and retail investors.

- The SIF was approved by SEBI in September 2024, and the rules for it were officially notified on December 16, 2024.

1. Specialised Investment Fund (SIF)

Key Features of SIF:

- Target Investors: Aimed at high-net-worth individuals (HNIs) and institutional investors who can invest large amounts.

- Minimum Investment: ₹10 lakh.

- Types of Investment Strategies Allowed:

- Open-ended funds (Open-ended funds are mutual funds where the number of units (or shares) in the fund is not fixed. The fund remains open for buying and selling units at any time.)

- Close-ended funds (Close-ended funds are mutual funds that have a fixed number of units. These funds are open for subscription only during the initial offering period. After that, the units are traded on the stock exchange, similar to how stocks are bought and sold.)

- Interval funds (with clear information on how often investors can buy or sell).

Investment Limits and Rules:

-

Debt Investments:

- No more than 20% of the total value (NAV) Net Asset Value can be invested in debt instruments from the same issuer.

- These investments must be rated investment grade by a credit rating agency.

- However, this 20% limit can go up to 25% if approved by the Board of Trustees and Board of Directors of the asset management company (AMC).

-

Exceptions to 20% Limit:

- The 20% limit does not apply to investments in:

- Government securities (like bonds issued by the government)

- Treasury bills (short-term government debt)

- Triparty repos (collateralized borrowing) on government securities or treasury bills.

- The 20% limit does not apply to investments in:

-

Equity Investments:

- A SIF cannot invest more than 10% of its total value (NAV) in the shares or equity-related instruments of a single company.

- The SIF cannot own more than 15% of the voting shares of any company.

Other Requirements for SIFs:

- Separate Identity: SIFs must be clearly different from regular mutual funds. This includes:

- Separate branding for the SIF.

- A separate website for the SIF, different from the mutual fund.

- Branding Rules: The asset management company (AMC) running the SIF must follow SEBI's rules on advertising, brand usage, and disclaimers to make sure there is no confusion between SIFs and regular mutual funds.

2. Mutual Fund Lite (MF Lite) Regulations

SEBI has also introduced Mutual Fund Lite (MF Lite) rules to make it easier to manage passively managed mutual fund schemes. These rules aim to reduce the cost and complexity of running such funds, helping them reach more investors, especially retail investors.

Key Features of MF Lite:

- Simplified Rules: The MF Lite regulations make it easier for asset management companies (AMCs) to set up and manage passively managed funds.

- These funds track the market rather than trying to beat it, which reduces the management costs.

- More Access for Investors: The goal is to make it easier for small investors to invest in mutual funds, offering more choices for diversifying their investments.

Sponsor Requirements:

- The sponsor (the company supporting the AMC) must have a strong track record of fair business practices and trustworthiness.

- The sponsor should contribute at least 40% of the AMC's net worth.

Net Worth Requirements for MF Lite AMCs:

- The AMC running MF Lite funds must have a minimum net worth of ₹35 crore.

- If the AMC has made a profit for five consecutive years, this net worth can be reduced to ₹25 crore.

3. Key Goals and Benefits of These Changes

The introduction of SIF and MF Lite regulations serves several important purposes:

a. Bridging the Gap Between Mutual Funds and PMS:

- SIFs are designed to offer something in between regular mutual funds (which are for retail investors) and portfolio management services (PMS), which are more personalized and targeted at wealthy individuals.

- SIFs provide high-net-worth individuals and institutions with more flexible options than traditional mutual funds, while not being as customized as PMS.

b. Boosting Retail Investment:

- The MF Lite regulations help make it easier to set up and manage passively managed funds, which means lower costs for investors.

- This can attract more retail investors and improve overall participation in mutual funds.

c. Encouraging New Investment Ideas:

- Both the SIF and MF Lite regulations allow asset managers to bring in new, creative investment strategies and products.

- This will help diversify the types of investment options available to investors.

d. Protecting Investors:

- SEBI has put strict rules in place for SIFs to ensure that investors are well-informed about how their money is being invested.

- For example, there are limits on how much a SIF can invest in any single company or debt instrument.

Conclusion

SEBI's changes to mutual fund rules with the introduction of the Specialised Investment Fund (SIF) and Mutual Fund Lite (MF Lite) regulations are a big step forward for India’s mutual fund industry. These changes will help create more investment options for both high-net-worth individuals (HNIs) and retail investors. By simplifying rules and allowing for more flexible investments, SEBI is aiming to improve market access, encourage innovation, and make it easier for people to invest in India’s growing economy.

| Also Read | |

| UPSC Prelims Result | UPSC Daily Current Affairs |

| UPSC Monthly Mgazine | Previous Year Interview Questions |

| Free MCQs for UPSC Prelims | UPSC Test Series |

| ENSURE IAS NOTES | Our Booklist |