- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- ABOUT US

- OUR TOPPERS

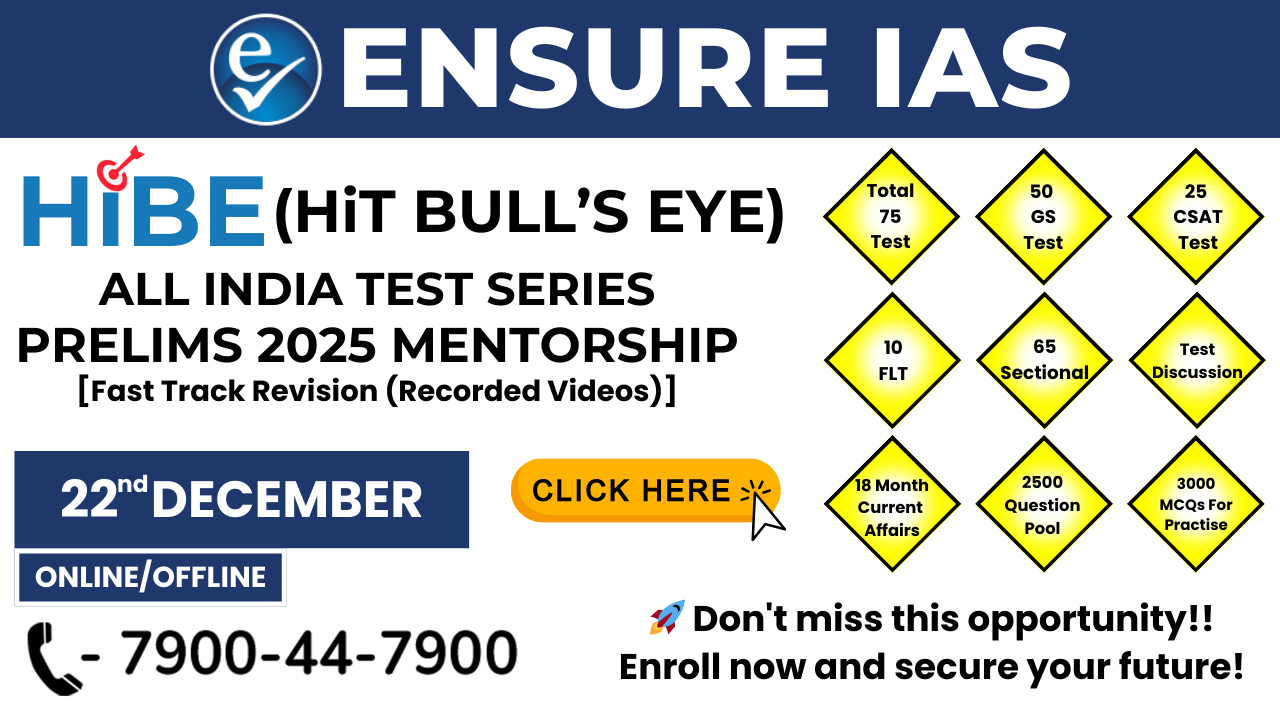

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Is Coconut Oil an Edible Oil or a Haircare Product? Supreme Court Ruling

Is Coconut Oil an Edible Oil or a Haircare Product? Supreme Court Ruling

21-12-2024

Background:

- The question of whether coconut oil should be classified as an edible oil or a hair care product for taxation purposes has been a subject of legal and tax debates for over 15 years in India.

- The issue became particularly relevant after the implementation of the Goods and Services Tax (GST) in 2017, as edible oils attract a 5% GST while hair care products attract an 18% GST.

Key Points of the Case:

-

GST Classification:

- Edible oils are taxed at 5% GST, whereas hair care products are taxed at a higher rate of 18%.

- This discrepancy in tax rates has created confusion, especially because coconut oil is used both as an edible oil (in cooking) and as a cosmetic or hair care product.

-

Historical Taxation Framework (Pre-GST):

- Before 2017, coconut oil was taxed under the Central Excise Tariff Act, 1985 (CET Act). It was included under:

- Section III: "Animal or Vegetable Fats and Oils" (with 8% excise duty).

- Section VI: "Preparations for use on the hair" (with 16% excise duty).

- In 2009, the Central Board of Excise and Customs (CBEC) issued a circular categorizing coconut oil in small containers (less than 200 ml) as hair oil, which was taxed at the higher 16% rate.

- However, this circular was withdrawn in 2015 after tribunals ruled that the size of the container should not determine the classification.

- Before 2017, coconut oil was taxed under the Central Excise Tariff Act, 1985 (CET Act). It was included under:

-

The Legal Dispute:

- In 2007, the Customs Excise and Service Tax Appellate Tribunal (CESTAT) in Chennai ruled that coconut oil is an edible oil, regardless of the size of the packaging.

- This decision was contested by the Commissioner of Central Excise, Salem, who appealed to the Supreme Court.

-

Supreme Court's Verdict:

- In 2018, a split verdict was delivered by the Supreme Court:

- Justice Ranjan Gogoi held that coconut oil should be classified as an edible oil, irrespective of the packaging size.

- Justice R Banumathi, applying the "Common Parlance Test", argued that coconut oil in small packets is perceived by the public as hair oil and should be taxed as such.

- However, in 2023, the Supreme Court issued a final ruling, saying that:

- The HSN (Harmonised System of Nomenclature) international standards, which are used for classification of goods, should take precedence.

- The mere size of the package is not sufficient to classify coconut oil as a hair care product.

- Both edible oils and hair oils can be sold in small-sized containers (e.g., 50 ml, 100 ml, 200 ml).

- Coconut oil, despite being used for cosmetic purposes, should be classified under edible oils for tax purposes and taxed at the 5% GST rate.

- In 2018, a split verdict was delivered by the Supreme Court:

Rationale Behind the Decision:

- The court emphasized that the international HSN classification norms clearly define coconut oil as an edible oil, irrespective of its usage as a cosmetic or hair care product.

- The court ruled that these norms should not be ignored in favor of the "common parlance test" unless there is ambiguity in the legal definitions.

- The common parlance test is used to determine how a product is understood by the public and the market.

- However, the Supreme Court ruled that in this case, since the product was clearly defined under the HSN norms and excise duties, the "common parlance test" was not applicable.

- The Court noted that the fact that coconut oil is used as a cosmetic or hair product does not automatically reclassify it as a hair oil for taxation purposes.

- The decision also relied on the idea that small packaging does not change the core classification of the product.

- Edible oils, including coconut oil, are commonly sold in small packets (e.g., 50 ml, 100 ml, 200 ml), which further supported the argument for lower GST rates.

Implications of the Ruling:

- Coconut oil will continue to be taxed at 5% GST, in line with its classification as an edible oil, even when sold in small containers.

- This ruling ensures that coconut oil manufacturers will benefit from the lower tax rate, which may affect pricing for consumers.

- The ruling is a reminder of the importance of international tax norms and the HSN classification system in determining taxation, rather than relying solely on consumer perceptions.

- It also reinforces the need for clarity in product classification, as the Court rejected the common parlance test when products are clearly defined under law.

- The ruling also aligns with previous cases, such as:

- Homeopathic Hair Oil (2023): Classified as a medicament under the CET Act, benefiting from a lower tax rate.

- Anardana Case (2022): The Supreme Court ruled that anardana (dried pomegranate seeds) falls under oilseeds for tax purposes, based on common usage.

What is HSN?HSN stands for Harmonized System Nomenclature, developed by the World Customs Organization (WCO) in 1988. It is a standardized international system for classifying goods for customs and taxation purposes, used by over 200 countries. How HSN Works:

HSN in India:

Structure of HSN Code:

HSN Code Structure:HSN codes are typically 6 to 8 digits long:

Example:For cotton T-shirts:

Importance of HSN:

|

| Also Read | |

| UPSC Prelims Result | UPSC Daily Current Affairs |

| UPSC Monthly Mgazine | Previous Year Interview Questions |

| Free MCQs for UPSC Prelims | UPSC Test Series |

| ENSURE IAS NOTES | Our Booklist |