- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

India’s Energy Import Bill Jumps 15% in FY25

India’s Energy Import Bill Jumps 15% in FY25

19-11-2024

- In November 2024, India’s net oil and gas import bill for the 1st seven months of the current financial year (FY25) increased by nearly 15% compared to the same period in the previous financial year.

- This is primarily due to the higher import volumes of crude oil, liquefied natural gas (LNG), and petroleum products, driven by rising demand and stagnant domestic production.

- Liquefied Natural Gas (LNG) is natural gas that has been cooled to a liquid state at around -162°C (-260°F) for easier storage and transportation.

- The liquefaction process reduces its volume by approximately 600 times, making it more efficient to ship across long distances, particularly where pipelines are not available.

- It is primarily composed of methane (CH₄), with small amounts of other gases like ethane and propane.

- The value of petroleum product exports also decreased, contributing to the growth in the net import bill.

- The data, released by the Petroleum Planning & Analysis Cell (PPAC) of the Ministry of Petroleum and Natural Gas, highlights the vulnerability of India’s economy to global energy price fluctuations and its heavy reliance on energy imports.

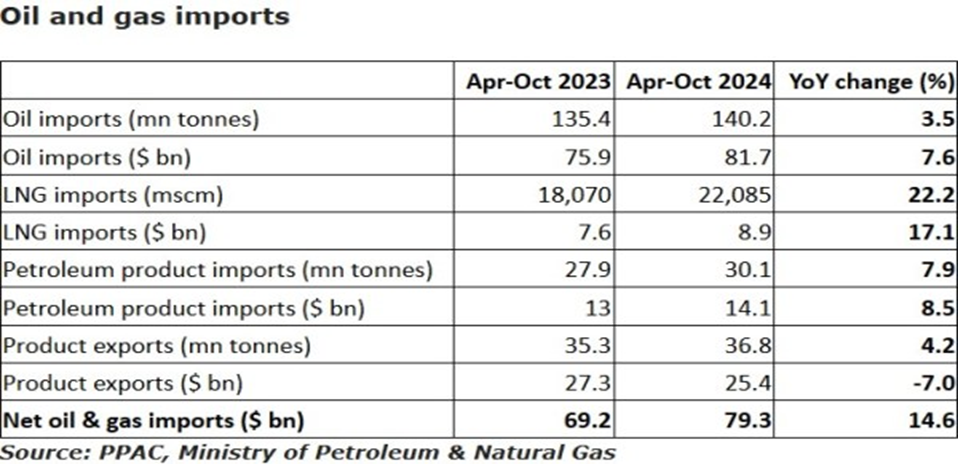

Key Data and Facts:

- Net Oil and Gas Import Bill:

- Net oil and gas imports in value terms for the April-October period stood at $79.3 billion, up from $69.2 billion in the same period last year.

- This represents a 15% year-on-year increase.

- Crude Oil Imports:

- India’s crude oil imports for April-October increased by 3.5% year-on-year, amounting to 140.2 million tonnes.

- The crude oil import bill for this period rose by 7.6%, reaching $81.7 billion.

- India’s oil import dependency increased to 88.1% (from 87.6% in the previous year).

- Domestic crude oil production fell by nearly 3%, reaching 16.7 million tonnes.

- Liquefied Natural Gas (LNG) Imports:

- LNG imports in value terms rose by 17.1% year-on-year to $8.9 billion.

- Volume of LNG imports increased by 22.2%, reaching 22,085 million standard cubic metres (mscm).

- India’s import dependency for natural gas stood at 51.3%, up from 46.7% in the previous year.

- Domestic natural gas output increased by 1.6%, totaling 20,948 mscm.

- Petroleum Product Imports and Exports:

- India’s petroleum product imports in value terms increased by 8.5%, totaling $14.1 billion.

- Petroleum product exports declined by nearly 7%, falling to $25.4 billion.

- India is a net exporter of petroleum products due to its refining capacity of over 250 million tonnes per annum, which slightly exceeds domestic demand.

Key Drivers of the Increased Import Bill

- Rising Domestic Demand:

- The growing demand for petroleum products, especially crude oil and natural gas, due to industrial growth, economic recovery, and increasing energy consumption, has led to a sharp rise in imports.

- Gas-based power plants have been a significant driver of the rising LNG demand, particularly during the peak summer months when electricity demand surges.

- Stagnant Domestic Production:

- Despite the growing demand, domestic production of both crude oil and natural gas has remained largely stagnant.

- Crude oil production fell by nearly 3% during April-October, while domestic natural gas output increased by just 1.6%, both of which are insufficient to meet the surging demand.

- Rising Global Oil Prices:

- The volatility in global oil prices continues to impact India’s import bill.

- A rise in global crude oil prices directly increases the cost of imports and puts pressure on the trade deficit, foreign exchange reserves, and inflation.

- Decline in Petroleum Product Exports:

- While India remains a net exporter of petroleum products, a decline in export value due to falling international prices has contributed to a larger net import bill.

Impact on India’s Economy and Energy Security

- Vulnerability to Global Price Shocks:

- India’s heavy reliance on imported crude oil and natural gas makes the country highly vulnerable to global energy price volatility, which can have cascading effects on inflation, the trade deficit, and the value of the rupee.

- The oil and gas import bill constitutes the largest share of India’s overall merchandise import bill, further impacting its current account deficit.

- Trade Deficit and Foreign Exchange Reserves:

- The increasing import bill is a significant factor in widening India’s trade deficit.

- The rising import expenditure is putting pressure on the country’s foreign exchange reserves and could lead to greater balance of payments concerns.

- India’s import dependency for crude oil now stands at 88.1%, and for natural gas at 51.3%, further exacerbating these challenges.

- Inflationary Pressures:

- Higher oil prices directly affect transportation costs, which in turn drives up the prices of goods and services across the economy, contributing to overall inflation.

- Rising energy costs also increase the cost of production in various sectors, adding further strain to the economy.

Government's Efforts to Address Import Dependency

- Focus on Increasing Domestic Production:

- The government is actively encouraging investment in domestic oil exploration and natural gas production.

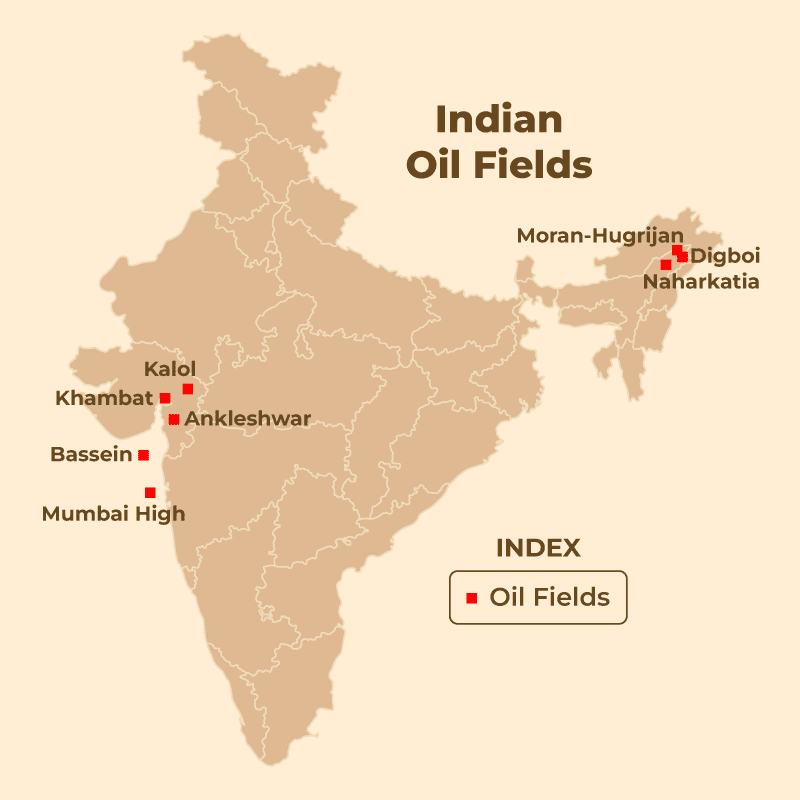

- However, increasing production has been a significant challenge, as most of India’s oil reserves are in deepwater and difficult-to-exploit areas.

- The government has also been pushing oil and gas companies to ramp up domestic production to mitigate rising import dependency.

- Promotion of Natural Gas as a Transition Fuel:

- India’s energy strategy involves increasing the consumption of natural gas, which is cleaner than crude oil and coal. However, this will require higher LNG imports as domestic gas production is insufficient.

- The government is also focusing on expanding the share of natural gas in the country’s primary energy mix, despite the expected increase in import levels.

- Renewable Energy Investments:

- India’s long-term strategy aims to reduce dependency on fossil fuels through a transition to renewable energy sources such as solar, wind, and hydropower.

- The National Hydrogen Mission and various policies are also geared towards promoting clean energy technologies, which could help reduce reliance on imported hydrocarbons over time.

- Promotion of Energy Efficiency:

- In addition to boosting renewable energy sources, the government is also focusing on energy efficiency and reducing energy wastage to meet the growing demand with less reliance on imports.

Conclusion

India’s net oil and gas import bill for April-October increased by 15% due to rising domestic demand and stagnant domestic production, with a higher volume of imports of crude oil, LNG, and petroleum products. This has resulted in a greater trade deficit, impacting foreign exchange reserves and inflation. India’s high import dependency for both oil and gas highlights the vulnerabilities in its energy security framework, making it sensitive to global price fluctuations.