- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

India's Carbon Market Revolution

India's Carbon Market Revolution

As the world's third-largest emitter, India faces the dual challenge of advancing its climate goals while maintaining developmental momentum.

- Recently, the finance minister announced a significant policy shift, transitioning "hard-to-abate" industries from energy efficiency targets to emission reduction targets. This move, a departure from the Perform, Achieve, and Trade (PAT) scheme, highlights a strategic effort to address emission-intensive sectors like iron and steel.

- India's step towards establishing its carbon market represents a crucial opportunity. While India’s Nationally Determined Contributions (NDCs) under the Paris Agreement do not mandate specific emission reductions, the creation of a carbon market underscores a commitment to exploring market-based solutions for emission control. Effective implementation will necessitate a delicate balance between climate objectives and developmental needs.

What is the Carbon Market?

Definition: Carbon markets are mechanisms designed to incentivize the reduction of greenhouse gas (GHG) emissions by creating financial rewards for emission reductions.

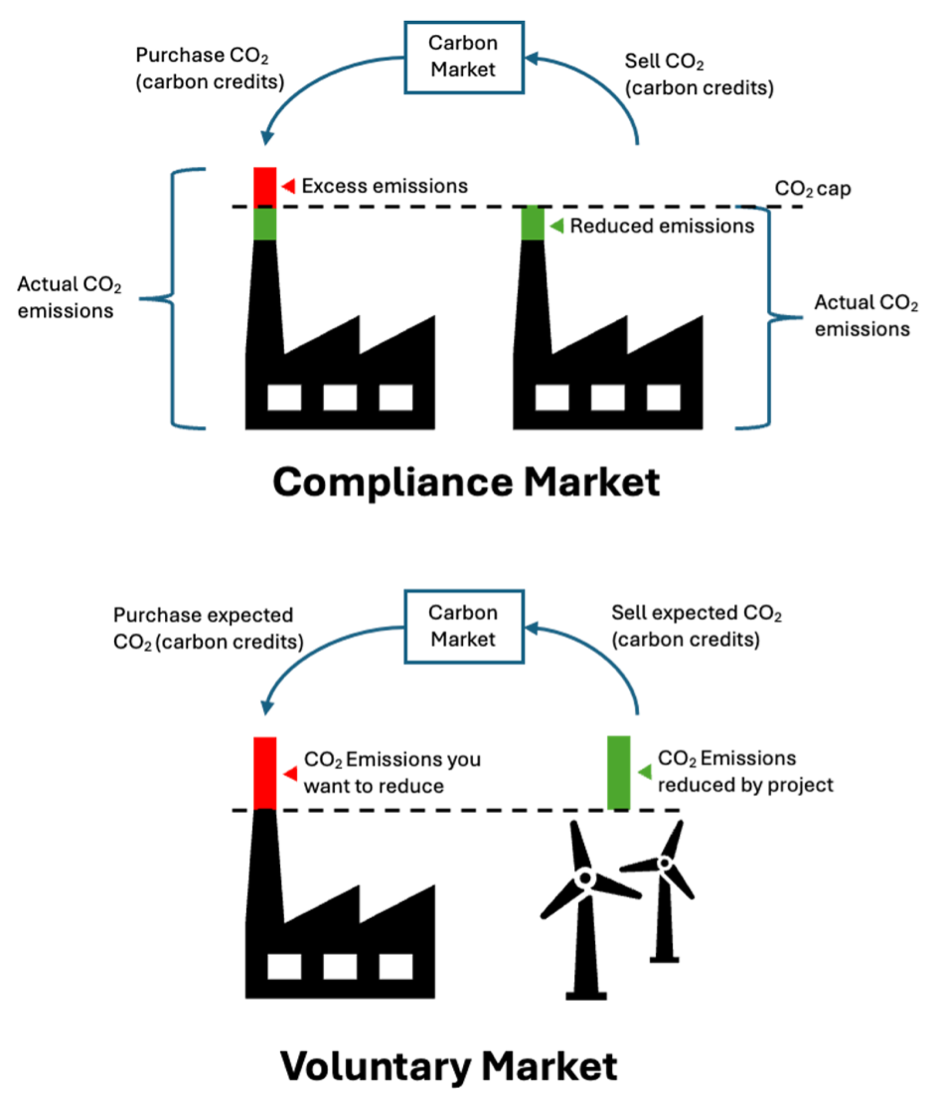

Types of Carbon Markets:

- Compliance Markets: Mandatory markets where regulated entities must buy carbon credits to offset their emissions. Typically, these markets involve large polluters.

- Voluntary Markets: Non-mandatory markets where entities voluntarily purchase carbon credits to offset their emissions beyond regulatory requirements.

India is a significant player in the voluntary market, contributing between USD 200-300 billion annually and accounting for 17% of global carbon credits supply in 2022.

Carbon Credits: Represent reductions in GHG emissions, with one credit equating to one ton of CO2 equivalent (tCO2e) avoided or reduced. Credits can be generated through activities like:

- Implementing energy-efficient technologies

- Reducing waste

- Transitioning to renewable energy sources

- Preventing deforestation or promoting reforestation

Carbon Taxes: Direct levies on GHG emissions, incentivizing polluters to reduce their carbon footprint. Revenue from carbon taxes can fund climate mitigation and adaptation projects or reduce other taxes.

Global Trends in Carbon Markets: As of August 2023, there are 74 carbon pricing mechanisms worldwide, either as carbon taxes or emissions trading schemes (ETS). Carbon pricing revenues reached a record USD 104 billion in 2023.

Current Government Initiatives Related to the Carbon Market in India

- Carbon Credits Trading Scheme (CCTS): Building on existing frameworks like the Electricity Conservation Act, 2001, and the Environment (Protection) Act, 1986, the CCTS aims to reduce GHG emissions through the trading of carbon credit certificates. The compliance segment is expected to commence in 2025-26.

- Existing Schemes: The PAT scheme and Renewable Energy Certificates (REC) system are in place for market-based emission reductions.

- Monitoring and Verification: The Bureau of Energy Efficiency (BEE) and the National Steering Committee for Indian Carbon Market (NSCICM) oversee the integrity of carbon credits through rigorous monitoring, reporting, and verification processes.

Advantages of Implementing a Carbon Tax

1. Incentivizing Green Innovation: A carbon tax encourages businesses to reduce their carbon footprint, fostering innovation in clean technologies. For example, British Columbia saw a 6.1% emission reduction in sectors covered by its carbon tax.

2. Revenue Generation for Climate Adaptation: Carbon taxes can raise substantial revenue for climate adaptation projects. In India, this could support flood protection, drought-resistant agriculture, and other critical measures. The IMF estimates that a USD 35 per ton carbon tax could raise 1-2% of GDP.

3. Improving Public Health: By reducing fossil fuel use, a carbon tax can enhance air quality and public health. An IMF estimate suggests a USD 50 per ton carbon tax could prevent 600,000 premature air pollution deaths annually by 2030.

4. Consumption Consciousness: A carbon tax raises awareness about the carbon footprint of products and services, influencing consumer behavior towards more sustainable choices.

Major Challenges Related to Carbon Taxation in India

1. Economic Impact on Industries: A carbon tax could increase production costs, particularly for energy-intensive industries like steel and cement, potentially affecting global competitiveness.

2. Regressive Nature: Carbon taxes may disproportionately impact lower-income groups who spend a larger share of their income on energy, exacerbating economic inequality.

3. Limited Scope: Carbon taxes may not adequately address other significant greenhouse gases like methane. Additional policies targeting non-CO2 gases are needed for comprehensive emission reductions.

4. The Informal Sector: Tracking and taxing emissions from India's large informal sector is challenging, potentially undermining the effectiveness of a carbon tax.

5. Inter-State Disparities: A uniform national carbon tax could disproportionately affect coal-producing states, highlighting the need for a nuanced approach.

6. Carbon Leakage: There is a risk that industries might relocate to regions with laxer regulations, a concern for India’s 'Make in India' initiative.

7. International Trade Implications: India’s exports could face challenges due to international carbon pricing mechanisms like the EU's Carbon Border Adjustment Mechanism (CBAM).

Measures for Effective Carbon Market Establishment

1. Phased Implementation: Gradually introduce carbon taxes with clear schedules of rate increases, allowing industries to adapt and invest in cleaner technologies.

2. Border Carbon Adjustments: Implement BCAs to level the playing field for domestic producers and mitigate carbon leakage, ensuring compliance with international trade rules.

3. Technology Transfer Incentives: Use tax revenue to fund technology transfer and adoption for SMEs, potentially through a "Clean Tech Adoption Fund."

4. Green Lanes for Carbon-Conscious Industries: Create incentives and expedited approvals for industries demonstrating significant carbon reduction efforts.

5. Carbon Credit Cooperative for SMEs: Develop a cooperative framework enabling SMEs to collectively participate in the carbon market and generate carbon credits.

6. Carbon Tech Incubators: Launch incubators for indigenous carbon reduction technologies, fostering a robust ecosystem of homegrown climate tech solutions.

7. Green Finance Revolution: Establish a green finance ecosystem, including green bonds and sustainability-linked loans, to support low-carbon projects.

8. Integration with Existing Schemes: Integrate the new carbon market with existing schemes like PAT and REC, potentially merging them into a comprehensive national carbon market.

Conclusion:

India stands at a crucial juncture, where the establishment of a carbon market can balance climate ambitions with economic growth. By strategically designing and implementing the carbon market, integrating existing frameworks, and fostering innovation, India can lead globally in sustainable development and climate action.