- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- NCERT- First Ladder

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- Current Affairs

- Indian Society and Social Issue

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Highlights of Union Budget 2024-25

Highlights of Union Budget 2024-25

|

I. Introduction

II. List of Budget Documents

III. Brief Description of Budget Documents

IV. Demands for Grants (DG)

V. Finance Bill

|

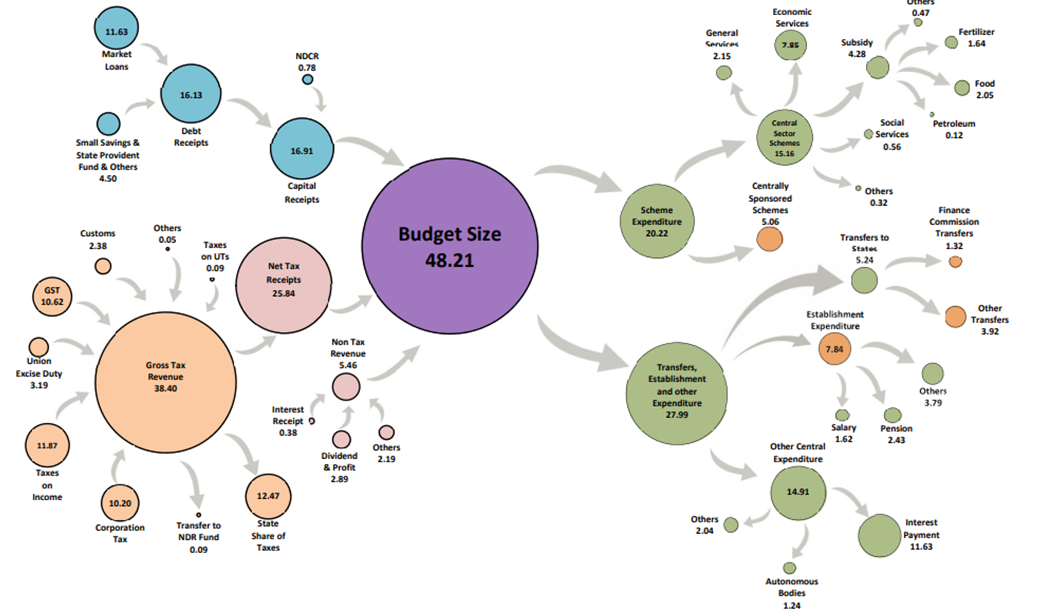

I. Introduction and Overview

The Union Budget 2024-25, presented by Finance Minister Nirmala Sitharaman, sets forth an ambitious plan for India's economic growth and development.

- This budget is noteworthy for its focus on four key areas: Employment, Skilling, MSMEs (Micro, Small, and Medium Enterprises), and the Middle Class.

- These priorities reflect the government's commitment to inclusive growth and addressing the challenges faced by various sectors of the economy.

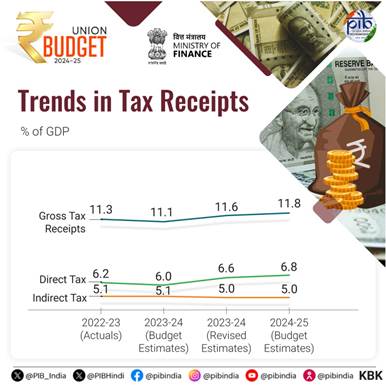

II. Macroeconomic Indicators and Fiscal Management

A. Budget Estimates 2024-25

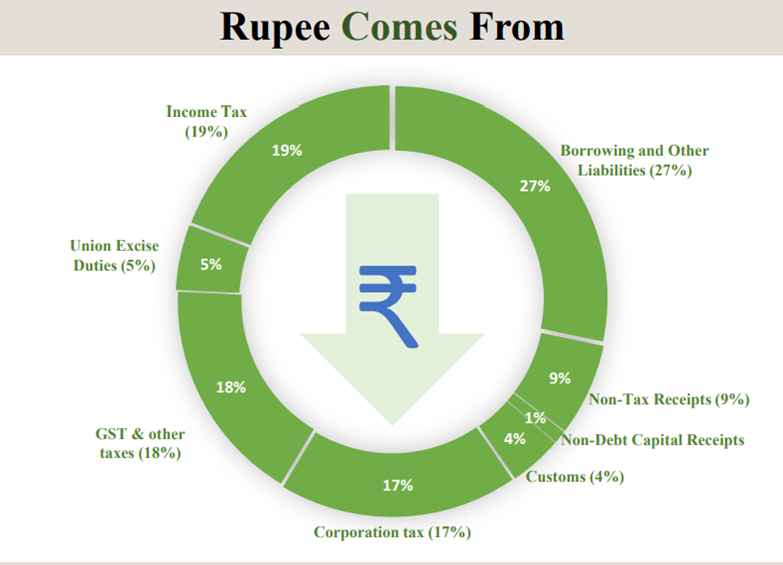

Rupee comes from:

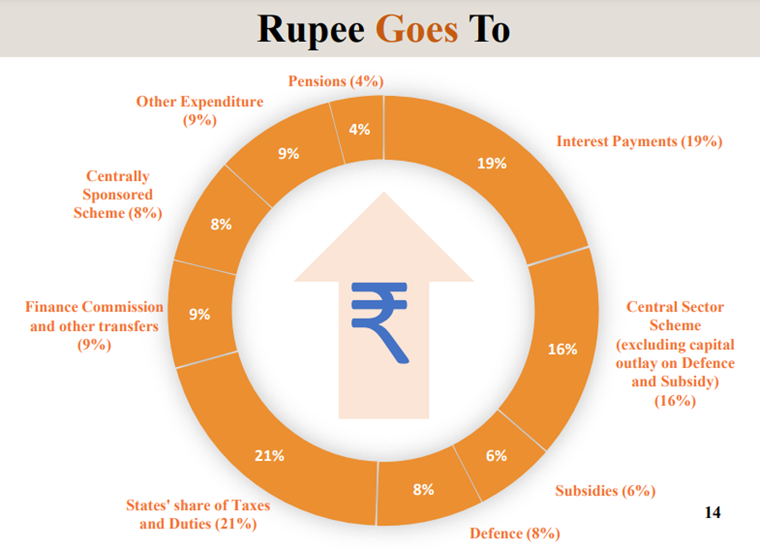

Rupees Goes To:

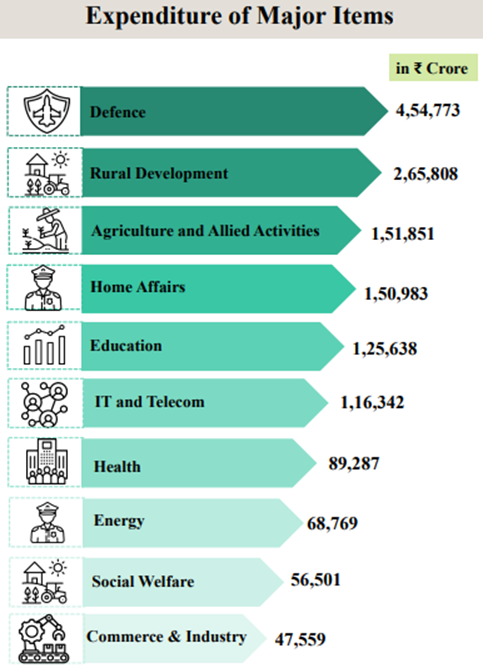

Expenditure of Major Items:

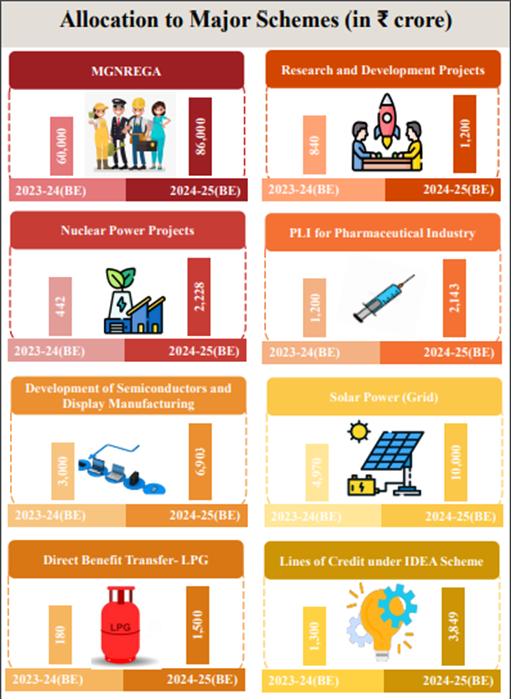

Allocation to Major Schemes:

- Total Receipts: ₹32.07 lakh crore (excluding borrowings)

- This figure represents the government's expected income from various sources, including taxes, disinvestments, and other non-tax revenues.

- Total Expenditure: ₹48.21 lakh crore

- This includes all government spending, including both revenue and capital expenditures.

- Net Tax Receipt: ₹25.83 lakh crore

- This is the amount the government expects to collect in taxes after accounting for states' share.

- Fiscal Deficit: 4.9% of GDP

- The fiscal deficit represents the difference between total revenue and total expenditure. The government aims to reduce this to below 4.5% in the following year, indicating a commitment to fiscal consolidation.

B. Inflation Management

- Current Status: Inflation is reported to be low and stable, moving towards the 4% target.

- Core Inflation: 3.1% (excluding food and fuel)

- This indicates that the Reserve Bank of India's monetary policy has been effective in controlling inflation, providing a stable economic environment for growth.

III. Prime Minister's Employment and Skilling Package

This comprehensive package aims to address unemployment and skill gaps in the Indian workforce, targeting 4.1 crore youth over a 5-year period.

A. Employment Schemes

- Scheme A - First Timers:

- Eligibility: Newly registered employees in EPFO

- Benefit: Up to ₹15,000 salary support

- Duration: Provided in 3 installments over first month

- Objective: Encourage formal employment for first-time job seekers

- The scheme is expected to benefit 210 lakh youth.

- Scheme B - Job Creation in Manufacturing:

- Target: Boost employment in the manufacturing sector

- Incentive: Direct support for both employee and employer EPFO contributions

- Duration: First 4 years of employment

- Aim: Stimulate job creation in the manufacturing sector, a key area for economic growth

- Scheme C - Support to Employers:

- Benefit: Reimbursement of up to ₹3,000 per month for employer's EPFO contribution

- Duration: 2 years

- Condition: Applicable for each additional employee hired

- Purpose: Incentivize employers to increase their workforce

B. Skilling Initiatives

- New Centrally Sponsored Skilling Scheme:

- Target: 20 lakh youth over 5 years

- Scope: Upgrade 1,000 Industrial Training Institutes (ITIs)

- Method: Hub and spoke arrangement for efficient skill dissemination

- Internship Program:

- Scale: 1 crore youth in 500 top companies

- Duration: Over 5 years

- Objective: Provide practical industry exposure to enhance employability

IV. Nine Budget Priorities for 'Viksit Bharat' (Developed India)

Priority 1: Boosting Agricultural Productivity and Resilience

- Financial Allocation: ₹1.52 lakh crore for agriculture and allied sectors

- Climate-Resilient Crop Varieties:

- Introduction of 109 high-yielding, climate-resilient varieties

- Covers 32 field and horticulture crops

- Aim: Enhance crop yield and farmers' income while adapting to climate change

- Natural Farming Initiatives:

- Target: 1 crore farmers to adopt natural farming practices

- Timeframe: Next 2 years

- Support: Establishment of 10,000 bio-input resource centers

- Benefits: Reduced chemical inputs, improved soil health, and potential for premium pricing of produce

- Digital Public Infrastructure (DPI) for Agriculture:

- Objective: Comprehensive digitization of agricultural data

- Coverage: All farmers and their landholdings

- Implementation Period: 3 years

- Expected Outcomes: Improved decision-making, targeted policies, and enhanced agricultural productivity

Priority 2: Enhancing Employment and Skill Development

- Women-Centric Initiatives:

- Working Women Hostels: To be established in collaboration with industry

- Crèches: Provision of childcare facilities to support working mothers

- Skilling Programs: Tailored to women's needs and market demands

- Market Access: Promotion of women Self-Help Group (SHG) enterprises

- Skill Development Loan Scheme:

- Revision of Model Skill Loan Scheme

- New Limit: Up to ₹7.5 lakh

- Purpose: Facilitate access to skill development programs

- Higher Education Support:

- Loan Facilitation: Up to ₹10 lakh for higher education in Indian institutions

- Target: Youth not eligible for existing government schemes

- Aim: Broaden access to quality higher education

Priority 3: Inclusive Human Resource Development and Social Justice

- Purvodaya Initiative:

- Focus: Development of Eastern India

- Key Project: Industrial node at Gaya (part of Amritsar-Kolkata Industrial Corridor)

- Power Sector Boost: New 2400 MW power plant at Pirpainti (₹21,400 crore investment)

- Andhra Pradesh Special Package:

- Financial Support: ₹15,000 crore through multilateral development agencies

- Industrial Development: Nodes at Kopparthy and Orvakal

- Women-Led Development:

- Total Allocation: Over ₹3 lakh crore for women and girl-centric schemes

- Tribal Development:

- Program: Pradhan Mantri Janjatiya Unnat Gram Abhiyan

- Coverage: 63,000 villages in tribal-majority and aspirational districts

- Beneficiaries: 5 crore tribal people

- North-Eastern Region Development:

- Banking Access: 100 new India Post Payment Bank branches

Priority 4: Strengthening Manufacturing and Services Sectors

- MSME Support:

- Credit Guarantee Scheme: Collateral-free loans for machinery purchase

- Stress Period Support: New mechanism to ensure continued bank credit

- Mudra Loans: Enhanced limit of ₹20 lakh under 'Tarun' category

- Trade Receivables Discounting System (TReDS):

- Expanded Scope: Turnover threshold for mandatory buyer onboarding reduced to ₹250 crore

- Food Processing Industry:

- Support for 50 multi-product food irradiation units in MSME sector

- E-Commerce Export Hubs:

- Public-Private Partnership model

- Target: MSMEs and traditional artisans

- Objective: Facilitate international market access

- Critical Mineral Mission:

- Focus: Domestic production, recycling, and overseas acquisition of critical minerals

- Offshore Mineral Exploration:

- First tranche of offshore block auctions for mineral mining

Priority 5: Urban Development and Housing

- Transit-Oriented Development:

- Target: 14 large cities with populations over 30 lakh

- Scope: Formulation of development plans and financing strategies

- Urban Housing Initiative:

- Investment: ₹10 lakh crore over 5 years

- Central Assistance: ₹2.2 lakh crore

- Program: PM Awas Yojana Urban 2.0

- Beneficiaries: 1 crore urban poor and middle-class families

- Street Market Development:

- Target: 100 weekly 'haats' or street food hubs annually

- Duration: 5 years

- Location: Select cities

Priority 6: Ensuring Energy Security and Transition

- Energy Transition Policy:

- Objective: Balance employment, growth, and environmental sustainability

- Pumped Storage Projects:

- Focus: Promote electricity storage capabilities

- Nuclear Energy Initiatives:

- R&D: Small and modular nuclear reactors

- Collaboration: Public-private partnerships for technology development

- Advanced Ultra Super Critical (AUSC) Thermal Power:

- Project: 800 MW commercial plant

- Collaboration: Joint venture between NTPC and BHEL

- Carbon Market Development:

- Target: 'Hard to abate' industries

- Transition: From 'Perform, Achieve and Trade' to 'Indian Carbon Market' mode

Priority 7: Infrastructure Development

- Central Government Infrastructure Investment:

- Allocation: ₹11,11,111 crore (3.4% of GDP)

- State Infrastructure Support:

- Provision: ₹1.5 lakh crore as long-term interest-free loans

- Rural Connectivity:

- Program: Pradhan Mantri Gram Sadak Yojana (PMGSY) Phase IV

- Target: All-weather connectivity to 25,000 rural habitations

- Irrigation and Flood Mitigation:

- Bihar Projects: ₹11,500 crore for Kosi-Mechi intra-state link and others

- Support for Assam, Himachal Pradesh, Uttarakhand, and Sikkim

- Tourism Development:

- Focus Areas: Temple corridors, monuments, wildlife sanctuaries, and natural landscapes

- Specific Projects: Vishnupad Temple Corridor, Mahabodhi Temple Corridor, Rajgir development

Priority 8: Promoting Innovation and R&D

- Anusandhan National Research Fund:

- Purpose: Support basic research and prototype development

- Private Sector R&D Financing:

- Pool: ₹1 lakh crore

- Objective: Spur research and innovation at commercial scale

- Space Economy Expansion:

- Venture Capital Fund: ₹1,000 crore

- Goal: 5x growth in space economy over 10 years

Priority 9: Implementing Next Generation Reforms

- Rural Land Management:

- Introduction of Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar

- Digitization of cadastral maps and land registries

- Integration with farmers registry

- Urban Land Digitization:

- GIS mapping of urban land records

- Labor Market Reforms:

- Integration of e-shram portal for one-stop solution

- Open architecture databases for labor market dynamics

- Job-aspirant to employer/skill provider connection mechanism

- NPS Vatsalya:

- New plan for parental contributions to minors' accounts

V. Tax Reforms

Indirect Taxes

GST : Buoyed by GST’s success, tax structure to be simplified and rationalised to expand GST to remaining sectors.

Sector specific customs duty proposals

Medicines and Medical Equipment:

- Three cancer drugs namely TrastuzumabDeruxtecan, Osimertinib and Durvalumab fully exempted from custom duty.

- Changes in Basic Customs Duty (BCD) on x-ray tubes & flat panel detectors for use in medical x-ray machines under the Phased Manufacturing Programme.

Mobile Phone and Related Parts:

- BCD on mobile phone, mobile Printed Circuit Board Assembly (PCBA) and mobile charger reduced to 15 per cent.

Precious Metals:

- Customs duties on gold and silver reduced to 6 per cent and that on platinum to 6.4 per cent.

Other Metals:

- BCD removed on ferro nickel and blister copper.

- BCD removed on ferrous scrap and nickel cathode.

- Concessional BCD of 2.5 per cent on copper scrap.

Electronics:

- BCD removed, subject to conditions, on oxygen free copper for manufacture of resistors.

Chemicals and Petrochemicals:

- BCD on ammonium nitrate increased from 7.5 to 10 per cent.

Plastics:

- BCD on PVC flex banners increased from 10 to 25 per cent.

Telecommunication Equipment:

- BCD increased from 10 to 15 per cent on PCBA of specified telecom equipment.

Trade facilitation:

- For promotion of domestic aviation and boat & ship MRO, time period for export of goods imported for repairs extended from six months to one year.

- Time-limit for re-import of goods for repairs under warranty extended from three to five years.

Critical Minerals:

- 25 critical minerals fully exempted from customs duties.

- BCD on two critical minerals reduced.

Solar Energy:

- Capital goods for use in manufacture of solar cells and panels exempted from customs duty.

Marine products:

- BCD on certain broodstock, polychaete worms, shrimp and fish feed reduced to 5 per cent.

- Various inputs for manufacture of shrimp and fish feed exempted from customs duty.

Leather and Textile:

- BCD reduced on real down filling material from duck or goose.

- BCD reduced, subject to conditions, on methylene diphenyl diisocyanate (MDI) for manufacture of spandex yarn from 7.5 to 5 per cent.

Direct Taxes:

- Efforts to simplify taxes, improve tax payer services, provide tax certainty and reduce litigation to be continued.

- Enhance revenues for funding development and welfare schemes of government.

- 58 per cent of corporate tax from simplified tax regime in FY23, more than two-thirds taxpayers availed simplified tax regime for personal income tax in FY 24.

Simplification for Charities and of TDS:

- Two tax exemption regimes for charities to be merged into one.

- 5 per cent TDS rate on many payments merged into 2 per cent TDS rate.

- 20 per cent TDS rate on repurchase of units by mutual funds or UTI withdrawn.

- TDS rate on e-commerce operators reduced from one to 0.1 per cent.

- Delay for payment of TDS up to due date of filing statement decriminalized.

Simplification of Reassessment:

- Assessment can be reopened beyond three years upto five years from the end of Assessment Year only if the escaped income is ₹ 50 lakh or more.

- In search cases, time limit reduced from ten to six years before the year of search.

Simplification and Rationalisation of Capital Gains:

- Short term gains on certain financial assets to attract a tax rate of 20 per cent.

- Long term gains on all financial and non-financial assets to attract a tax rate of 12.5 per cent.

- Exemption limit of capital gains on certain financial assets increased to ₹ 1.25 lakh per year.

Tax Payer Services:

- All remaining services of Customs and Income Tax including rectification and order giving effect to appellate orders to be digitalized over the next two years.

Litigation and Appeals:

- ‘Vivad Se Vishwas Scheme, 2024’ for resolution of income tax disputes pending in appeal.

- Monetary limits for filing direct taxes, excise and service tax related appeals in Tax Tribunals, High Courts and Supreme Court increased to ₹60 lakh, ₹2 crore and ₹5 crore respectively.

- Safe harbour rules expanded to reduce litigation and provide certainty in international taxation.

Employment and Investment:

- Angel tax for all classes of investors abolished to bolster start-up eco-system,.

- Simpler tax regime for foreign shipping companies operating domestic cruises to promote cruise tourism in India.

- Safe harbour rates for foreign mining companies selling raw diamonds in the country.

- Corporate tax rate on foreign companies reduced from 40 to 35 per cent.

Deepening tax base

- Security Transactions Tax on futures and options of securities increased to 0.02 per cent and 0.1 per cent respectively.

- Income received on buy back of shares in the hands of recipient to be taxed.

Social Security Benefits.

- Deduction of expenditure by employers towards NPS to be increased from 10 to 14 per cent of the employee’s salary.

- Non-reporting of small movable foreign assets up to ₹20 lakh de-penalised.

Other major proposal in Finance Bill

- Equalization levy of 2 per cent withdrawn.

Changes in Personal Income Tax under new tax regime

- Standard deduction for salaried employees increased from ₹50,000 to ₹75,000.

- Deduction on family pension for pensioners enhanced from ₹15,000/- to ₹25,000/-

- Revised tax rate structure:

|

0-3 lakh rupees |

Nil |

|

3-7 lakh rupees |

5 per cent |

|

7-10 lakh rupees |

10 per cent |

|

10-12 lakh rupees |

15 per cent |

|

12-15 lakh rupees |

20 per cent |

|

Above 15 lakh rupees |

30 per cent |

- Salaried employee in the new tax regime stands to save up to ₹ 17,500/- in income tax.

VI. Conclusion

The Union Budget 2024-25 presents a comprehensive roadmap for India's economic development, focusing on inclusive growth, infrastructure development, and strategic reforms. By addressing key areas such as employment, agriculture, energy transition, and tax simplification, the budget aims to stimulate economic activity while ensuring fiscal prudence. The success of these initiatives will depend on effective implementation and the ability to adapt to changing global economic conditions.

Must Check: Best IAS Coaching In Delhi

UPSC Prelims Result 2024 Out: Expected Cut Off & Other Details, UPSC Prelims 2024 Answer with Explanation, Daily Prelims Quiz, Daily Current Affairs, MONTHLY CURRENT AFFAIRS TOTAL (CAT) MAGAZINE, Best IAS Coaching Institute in Karol Bagh, Best IAS Coaching Institute in Delhi, Daily Mains Question Answer Practice, ENSURE IAS UPSC Toppers, UPSC Toppers Marksheet, Previous Year Interview Questions, UPSC Syllabus