- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

FINANCES OF PANCHAYATI RAJ INSTITUTIONS

FINANCES OF PANCHAYATI RAJ INSTITUTIONS

12-02-2024

- In Jan 2024, the Reserve Bank of India (RBI) released a report titled 'Finances of Panchayati Raj Institutions' for the fiscal year 2022-23, revealing insights into the financial aspects of Panchayati Raj Institutions (PRIs) in India.

-

What is a Panchayati Raj Institution?

- The 73rd Constitutional Amendment Act, 1992 conferred constitutional status to the Panchayati Raj Institutions (PRIs) and established a uniform structure with three tiers.

- PRIs operate at three levels: gram sabhas (village or group of small villages), panchayat samithis (block council), and zila parishads (district).

- Article 243G of the Indian Constitution grants state legislatures the authority to empower Panchayats to function as self-government institutions.

- Provisions for the financial empowerment of Panchayats are outlined in Article 243H, Article 280(3)(bb), and Article 243-I of the Constitution.

-

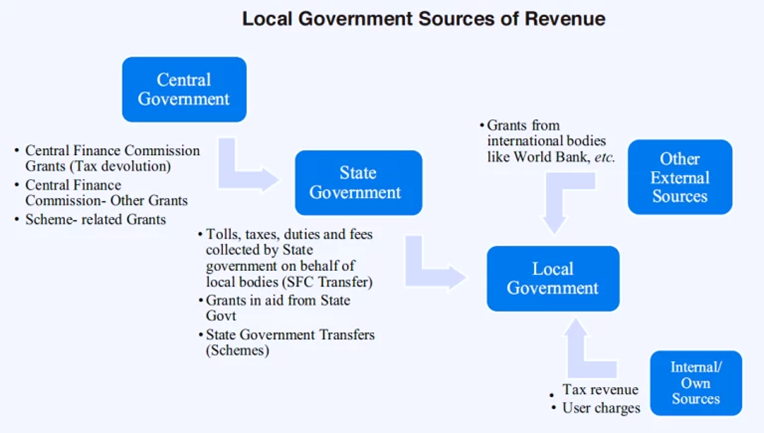

Financial Empowerment of Panchayats:

- Article 243H empowers state legislatures to authorize Panchayats to levy, collect, and appropriate (assign) taxes, duties, tolls, and fees, subject to conditions and limits.

- Article 280(3)(bb) mandates Central Finance Commission to recommend measures to increase Consolidated Fund of a State to support Panchayat resources based on State Finance Commission recommendations.

- Article 243-I mandates the formation of State Finance Commissions every five years to review the financial status of Panchayats.

- They advise the Governor on distribution principles of taxes, duties, tolls, and fees, measures to improve financial position, and other finance-related matters.

- Role of the Ministry of Panchayati Raj: The Ministry of Panchayati Raj oversees all matters related to the Panchayati Raj and Panchayati Raj Institutions, established in May 2004.

-

Key Highlights of the Report:

-

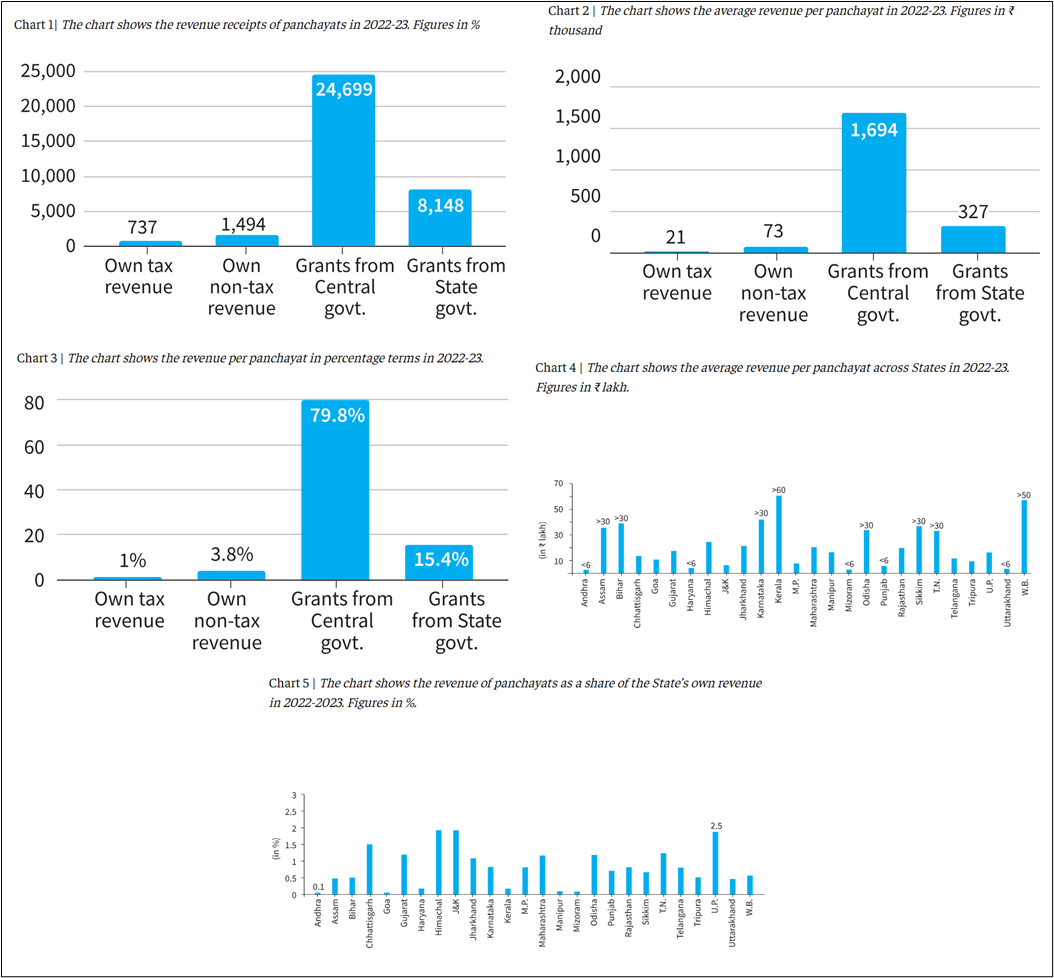

Revenue Composition:

-

-

- Panchayats derive only 1% of their revenue from taxes.

- The majority of their revenue comes from grants provided by the Centre and the States.

- Data shows that 80% of the revenue is from Central government grants, while 15% is from State government grants.

-

-

Revenue Statistics:

-

-

- In the fiscal year 2022-23, panchayats recorded a total revenue of nearly Rs 35,350 crore.

- Only Rs 740 crore was generated through their own tax revenue, which includes taxes on profession and trades, land revenue, stamps and registration fees, taxes on property, and service tax.

- Non-tax revenue amounted to nearly Rs 1,500 crore, mainly from interest payments and Panchayati Raj programs.

- Notably, panchayats received Rs 24,700 crore in grants from the Central government and Rs 8,150 crore from State governments.

-

-

Revenue Per Panchayat:

-

-

- On average, each panchayat earned just Rs 21,000 from its own tax revenue and Rs 73,000 from non-tax revenue.

- In contrast, grants from the Central government amounted to approximately Rs 17 lakh per panchayat, with State government grants totalling over Rs 3.25 lakh per panchayat.

-

-

State Revenue Share and Inter-State Disparities (inequality):

-

-

- Panchayats' share in their respective State's own revenue remains minimal.

- For instance, in Andhra Pradesh, revenue receipts of panchayats constitute just 0.1% of the State’s own revenue, while in Uttar Pradesh, it forms 2.5%, the highest among states.

- There are significant variations among states regarding average revenue earned per panchayat.

- Kerala and West Bengal lead with average revenues of over Rs 60 lakh and Rs 57 lakh per panchayat, respectively.

- The revenue was over Rs 30 lakh per panchayat in Assam, Bihar, Karnataka, Odisha, Sikkim, and Tamil Nadu.

- States like Andhra Pradesh, Haryana, Mizoram, Punjab, and Uttarakhand have significantly lower average revenues, less than Rs 6 lakh per panchayat.

-

-

Recommendations of RBI:

-

-

- The RBI proposes greater decentralization and empowerment of local leaders and officials, along with measures to enhance financial autonomy and sustainability of Panchayati Raj.

- The report suggests PRIs to improve resource utilization through transparent budgeting, fiscal discipline, community involvement, staff training, and monitoring.

-

Reasons for Panchayats Facing Funding Related Issues

-

Limited Taxation:

-

-

- PRIs have limited powers to impose taxes and often receive insufficient funds from the State Government.

- They hesitate to raise funds fearing loss of popularity.

-

-

Low Capacity and Utilization:

-

-

- PRIs may lack the skills to generate revenue from fees, tolls, etc.

- Challenges in efficient fund utilization due to poor planning and monitoring.

-

-

Fiscal Decentralisation Issues:

-

-

- Insufficient devolution (distribution) of financial powers hampers (hinder/obstruct) their ability to mobilize resources independently.

- Limited fiscal decentralization weakens local governance and community empowerment.

-

Repercussions (consequence) of Panchayats’ Financial Dependence

- Dependence on external funding leads to interference from higher government levels.

- Delayed release of funds by State governments forces panchayats to seek private funds.

- Some regions face non-receipt of funds under key schemes, affecting their functioning.

- The Standing Committee on Rural Development and Panchayati Raj reported that 19 out of 34 State/UTs did not receive funds under the Rashtriya Gram Swaraj Abhiyan scheme in FY23.

-

- The Standing Committee on Rural Development and Panchayati Raj is responsible for examining demands for grants for each financial year from the Ministry/Department under its purview (scope).

- The Rashtriya Gram Swaraj Abhiyan (RGSA) is a scheme launched by the Ministry of Panchayati Raj in 2018 to strengthen the Panchayati Raj system in rural areas.

-

Government Initiatives to Strengthen Panchayati Raj Institutions (PRIs)

- e-Gram Swaraj e-Financial Management System: It's a Simplified Work Based Accounting Application for Panchayati Raj that enhances the credibility of Panchayat by devolving funds to PRIs.

- Saansad Adarsh Gram Yojana: It focuses holistic development of villages, transforming them into Adarsh Grams.

-

- Each Member of Parliament (MP) is tasked with promoting development of three Gram Panchayats (GPs) by 2019 and another 5 GPs by 2024.

-

- LSDGs through PRIs: The Ministry adopts a thematic approach for Local Sustainable Development Goals (LSDGs) leveraging (use to maximum advantage) third tier of Government, with goals to be attained by 2030.

- Panchayat Development Index (PDI): MoPR constituted a committee to prepare mechanisms for computation of PDI to measure progress on LSDGs and carry out evidence-based policy assessment.

- Gram Urja Swaraj Abhiyaan: MoPR collaborates with the Ministry of New and Renewable Energy to include Gram Panchayats under all its schemes, focusing on renewable energy adoption for self-sufficiency.

- National Panchayati Raj Day (NPRD): Celebrated annually on April 24th by MoPR to commemorate the 73rd Constitutional Amendment Act of 1992.

- Theme for 2023: "Panchayaton ke Sankalpon ki Siddhi ka Utsav" celebrates adopting a "whole-of-society" and "whole-of-government" approach.