- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Economic Survey 2023-24 Highlights

Economic Survey 2023-24 Highlights

23-07-2024

The Economic Survey, a comprehensive report on the state of the Indian economy, was released by Union Finance Minister Nirmala Sitharaman on Monday (July 22), the first day of the monsoon session of Parliament, a day before the Union Budget.

- The survey is usually released on January 31, but in election years like 2024, it is released in July after the dissolution of parliament and the conclusion of elections.

What is the Economic Survey?

- The Economic Survey is a detailed report on the state of the national economy in the financial year that is coming to a close.

- It is prepared by the Economic Division of the Department of Economic Affairs (DEA) in the Union Finance Ministry, under the guidance of the Chief Economic Adviser.

- The first Economic Survey was presented for 1950-51, and until 1964, it was presented along with the Budget.

- The survey typically covers various key sectors of the economy, such as services, agriculture, and manufacturing, as well as key policy areas like fiscal developments, state of employment, and inflation.

- The survey also carries a detailed statistical abstract.

What is the Economic Survey's significance?

- The survey remains the most authoritative and comprehensive analysis of the economy conducted from within the Union government.

- Its observations and details provide an official framework for analyzing the Indian economy.

- Although it comes just a day before the Budget, the assessment and recommendations carried out in the survey are not binding on the Budget.

The main highlights of the Economic Survey are as follows;:

Chapter 1: State of the Economy – Steady as She Goes

- GDP Growth Projection:

- Conservative projection of 6.5–7% real GDP growth for FY25

- Risks are evenly balanced

- Market expectations are on the higher side

- Economic Performance FY24:

- Real GDP grew by 8.2%

- Exceeded 8% in three out of four quarters

- Gross Value Added (GVA) grew by 7.2%

- Net taxes at constant prices grew by 19.1%

- Inflation Management:

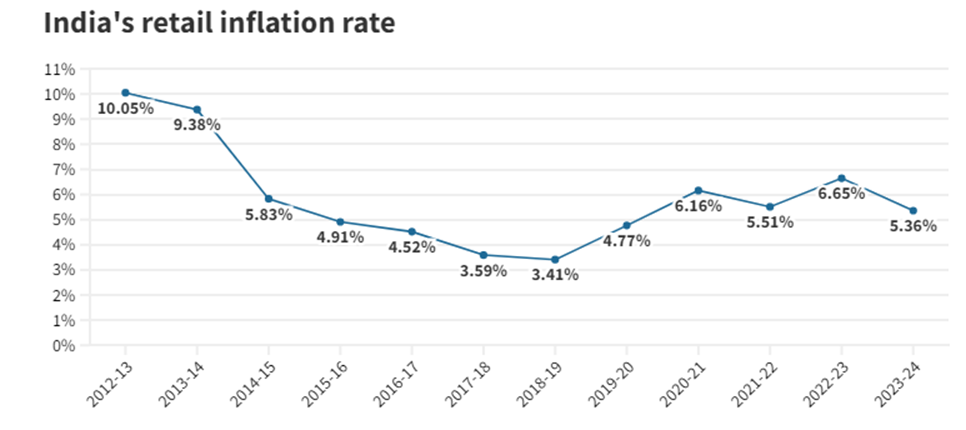

- Retail inflation reduced from 6.7% in FY23 to 5.4% in FY24

- Achieved through administrative and monetary policy management

- External Sector:

- Current Account Deficit (CAD) improved to 0.7% of GDP in FY24

- Down from 2.0% in FY23

- Post-Pandemic Recovery:

- Real GDP in FY24 was 20% higher than FY20 levels

- A feat achieved by very few major economies

- Fiscal Measures:

- 55% of tax collected from direct taxes, 45% from indirect taxes

- Enhanced capital spending allocation

- Free food grains provided to 81.4 crore people

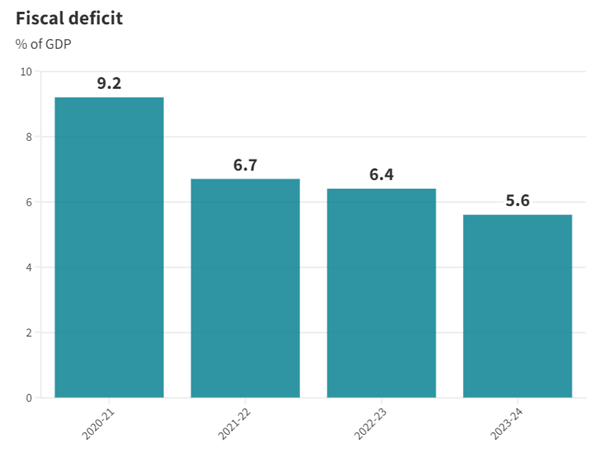

- India has continued to reduce its fiscal deficit, going against the global trend of increasing deficits. According to recent data, the fiscal deficit has decreased from 6.4% of GDP in FY23 to 5.6% of GDP in FY24.

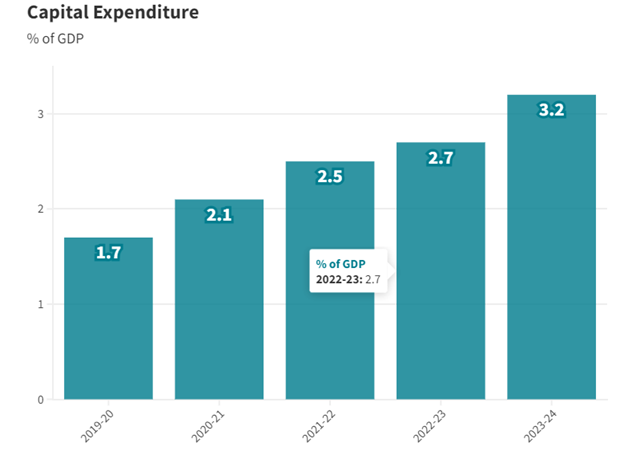

- India's capital expenditure in FY24 reached ₹9.5 lakh crore, a 28.2% year-over-year increase, and nearly triple the level of FY20.

- The government's focus on capital expenditure has been a key factor in driving economic growth despite global uncertainty.

Chapter 2: Monetary Management and Financial Intermediation - Stability is the Watchword

- Banking Sector Performance:

- Stellar performance in FY24

- RBI maintained steady policy rate at 6.5%

- Overall inflation under control

- Credit Growth:

- Credit disbursal by Scheduled Commercial Banks: ₹164.3 lakh crore

- 20.2% growth by end of March 2024

- Double-digit and broad-based growth

- Money Supply:

- Broad money (M3) growth: 11.2% (YoY) as of 22 March 2024

- Excluding impact of HDFC merger with HDFC Bank

- Banking Sector Health:

- Gross and net non-performing assets at multi-year lows

- Improved bank asset quality

- Sector-wise Credit Growth:

- Robust growth in services and personal loans

- Agriculture and allied activities: Double-digit growth

- Industrial credit growth: 8.5% (up from 5.2% a year ago)

- Insolvency and Bankruptcy Code (IBC):

- Recognized as an effective solution for twin balance sheet problem

- 31,394 corporate debtors disposed of in 8 years

- Total value: ₹13.9 lakh crore

- Capital Markets:

- Primary capital markets facilitated ₹10.9 lakh crore capital formation in FY24

- Market capitalization to GDP ratio: Fifth largest globally

- Financial Inclusion:

- Recognized as an enabler for sustainable economic growth

- Next challenge: Digital Financial Inclusion (DFI)

- Emerging Trends:

- Reduced dominance of banking support to credit

- Rising role of capital markets

- India poised to be one of the fastest-growing insurance markets

- Indian microfinance sector: Second largest globally after China

Chapter 3: Prices and Inflation - Under Control

- Inflation Management:

- Retail inflation at 5.4% - lowest since the pandemic

- Government interventions and RBI's measures credited

- Fuel Price Management:

- Price cuts for LPG, petrol, and diesel

- LPG price reduced by ₹200 per cylinder

- Petrol and diesel prices lowered by ₹2 per litre

- Core Inflation:

- Core services inflation: Nine-year low in FY24

- Core goods inflation: Four-year low

- Core consumer durables inflation declined

- Agricultural Challenges:

- Extreme weather events, depleted reservoirs, crop damage

- Food inflation: 7.5% in FY24 (up from 6.6% in FY23)

- Government Actions:

- Dynamic stock management

- Open market operations

- Subsidized provision of essential food items

- Trade policy measures

- State-wise Inflation:

- 29 States and Union Territories: Inflation below 6% in FY24

- Higher overall inflation states tend to have wider rural-to-urban inflation gap

- Future Projections:

- RBI projects inflation to fall to 4.5% in FY25 and 4.1% in FY26

- IMF forecasts: 4.6% in 2024 and 4.2% in 2025 for India

Chapter 4: External Sector - Stability Amid Plenty

- Logistics Performance:

- India's rank improved from 44th in 2018 to 38th in 2023

- World Bank's Logistics Performance Index

- Current Account Deficit:

- Narrowed to 0.7% in FY24

- Improved due to moderation in merchandise imports and rising services exports

- Global Export Share:

- India's share in global goods exports: 1.8% in FY24

- Up from average of 1.7% during FY16-FY20

- Services Exports:

- Grew by 4.9% to USD 341.1 billion in FY24

- Driven by IT/software services and 'other' business services

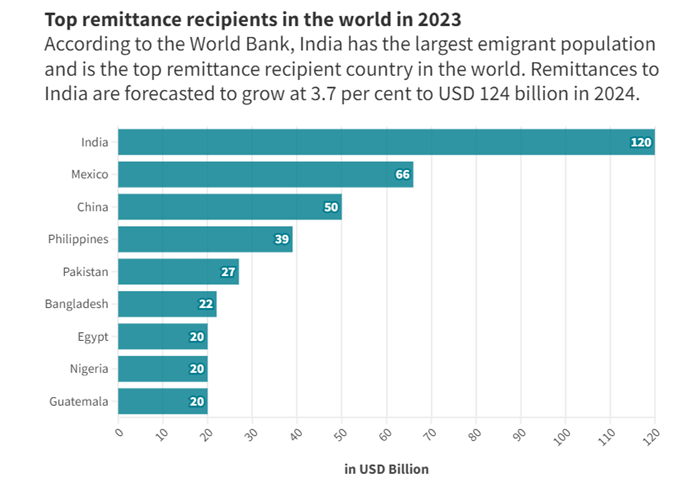

- Remittances:

-

- India is the top remittance recipient country globally

- Reached USD 120 billion in 2023

- Forex Reserves: Sufficient to cover more than 10 months of projected imports for FY25.

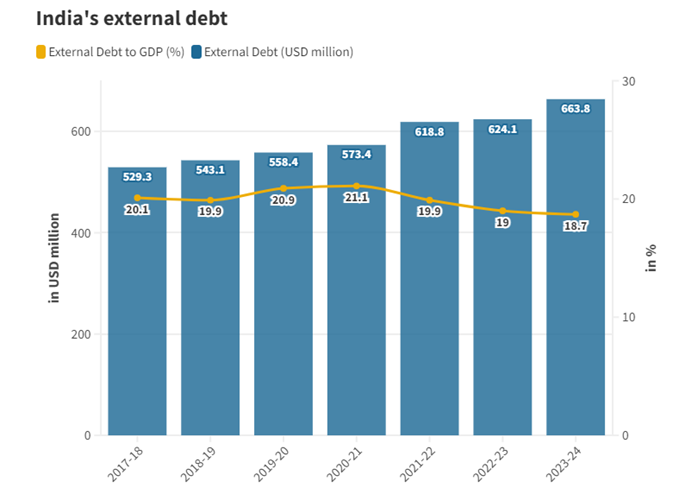

- External Debt:

- India's external debt indicators remain stable, with external debt at 18.7% of GDP as of March 2024.

- Additionally, foreign exchange reserves cover 97.4% of total debt, indicating a comfortable position.

Chapter 5: Medium-Term Outlook – A Growth Strategy for New India

- Key Policy Focus Areas:

- Job and skill creation

- Tapping agriculture sector potential

- Addressing MSME bottlenecks

- Managing green transition

- Dealing with Chinese conundrum

- Deepening corporate bond market

- Tackling inequality

- Improving young population's health quality

- Amrit Kaal Growth Strategy:

- Boosting private investment

- Expansion of MSMEs

- Agriculture as growth engine

- Financing green transition

- Bridging education-employment gap

- Building capacity of States

- Growth Target:

- 7%+ growth requires tripartite compact between Union Government, State Governments, and private sector

Chapter 6: Climate Change and Energy Transition: Dealing with Trade-Offs

- International Recognition:

- India recognized as only G20 nation in line with 2-degree Celsius warming

- Renewable Energy Progress:

- Non-fossil sources in installed electricity generation capacity: 45.4% (as of 31 May 2024)

- Emission Reduction:

- Reduced emission intensity of GDP by 33% from 2005 levels in 2019

- GDP CAGR (2005-2019): 7%, Emissions CAGR: 4%

- Clean Energy Initiatives:

- Coal Gasification Mission launched

- Annual energy savings: 51 million tonnes of oil equivalent

- Cost savings: ₹1,94,320 crore

- Emissions reduction: 306 million tonnes

- Green Bonds:

- Sovereign green bonds issued: ₹16,000 crore (Jan-Feb 2023)

- Additional ₹20,000 crore (Oct-Dec 2023)

Chapter 7: Social Sector - Benefits that Empower

- Welfare Approach:

- Focus on increasing impact per rupee spent

- Digitization as force multiplier in healthcare, education, and governance

- Welfare Expenditure Growth:

- CAGR of 12.8% between FY18 and FY24

- Compared to nominal GDP CAGR of 9.5%

- Inequality Reduction:

- Gini coefficient declined:

- Rural: 0.283 to 0.266

- Urban: 0.363 to 0.314

- Gini coefficient declined:

- Healthcare:

- Over 34.7 crore Ayushman Bharat cards generated

- 7.37 crore hospital admissions covered

- 22 mental disorders covered under Ayushman Bharat – PMJAY

- Education:

- 'Poshan Bhi Padhai Bhi' programme for early childhood education

- Vidyanjali initiative benefited over 1.44 crore students

- Higher education enrolment increase:

- Driven by SC, ST, and OBC sections

- 31.6% increase in female enrolment since FY15

- Research and Development:

- Nearly one lakh patents granted in FY24

- Up from less than 25,000 in FY20

- Housing and Infrastructure:

- PM-AWAS-Gramin: 2.63 crore houses constructed in last nine years

- Gram Sadak Yojana: 15.14 lakh km road construction completed since 2014-15

Chapter 8: Employment and Skill Development: Towards Quality

- Labor Market Improvements:

- Unemployment rate declined to 3.2% in 2022-23

- Quarterly urban unemployment rate (15 years and above): 6.7% in Q1 2024

- Sectoral Employment:

- Agriculture: 45%

- Manufacturing: 11.4%

- Services: 28.9%

- Construction: 13.0%

- Youth Employment:

- Youth (15-29 years) unemployment rate declined from 17.8% (2017-18) to 10% (2022-23)

- Two-thirds of new EPFO subscribers from 18-28 years band

- Gender Perspective:

- Female labor force participation rate (FLFPR) rising for six years

- Organized Manufacturing Sector:

- Employment recovered above pre-pandemic level

- Employment per factory continuing pre-pandemic rise

- Wage Growth:

- Rural areas: 6.9% CAGR (FY15-FY22)

- Urban areas: 6.1% CAGR (FY15-FY22)

- Factory Employment:

- 11.8% growth in factories employing more than 100 workers (FY18 to FY22)

- EPFO Additions:

- Net payroll additions more than doubled: 61.1 lakh (FY19) to 131.5 lakh (FY24)

- EPFO membership grew at 8.4% CAGR (FY15-FY24)

- Gig Economy:

- Expected to expand to 2.35 crore workers by 2029-30

- Job Creation Needs:

- Need to generate 78.5 lakh jobs annually until 2030 in non-farm sector

- Demographic Shift:

- Working-age population to increase from 50.7 crore (2022) to 64.7 crore (2050)

- Public Investment Impact:

- 2% of GDP investment can generate 11 million jobs (70% for women)

Chapter 9: Agriculture and Food Management – Plenty of Upside Left If We Get It Right

- Sector Growth:

- Agriculture and allied sector: 4.18% average annual growth rate (last five years)

- Allied Sectors:

- Emerging as robust growth centers

- Promising sources for improving farm incomes

- Agricultural Credit:

- Total credit disbursed: ₹22.84 lakh crore (as of 31 January 2024)

- 7.5 crore Kisan Credit Cards issued with ₹9.4 lakh crore limit

- Micro Irrigation:

- 90.0 lakh hectares covered under Per Drop More Crop (PDMC) scheme (2015-16 to 2023-24)

- Research Investment:

- ₹13.85 payoff for every rupee invested in agricultural research

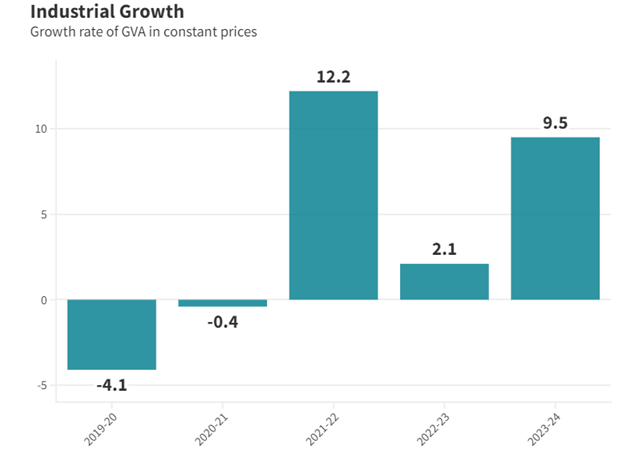

Chapter 10: Industry - Small and Medium Matters

- Industrial Growth:

- 9.5% growth rate supporting overall economic growth of 8.2% in FY24

- Manufacturing Sector:

- 5.2% average annual growth rate in last decade

- Key growth drivers: chemicals, wood products, furniture, transport equipment, pharmaceuticals, machinery, and equipment

- Coal Production:

- Accelerated production reduced import dependence

- Pharmaceutical Market:

- World's third-largest by volume

- Valuation: USD 50 billion

- Textile Industry:

- World's second-largest clothing manufacturer

- Among top five exporting nations

- Electronics Manufacturing:

- 3.7% of global market share in FY22

- PLI Schemes Impact:

- Attracted over ₹1.28 lakh crore investment (until May 2024)

- Led to production/sales of ₹10.8 lakh crore

- Generated over 8.5 lakh jobs (direct & indirect)

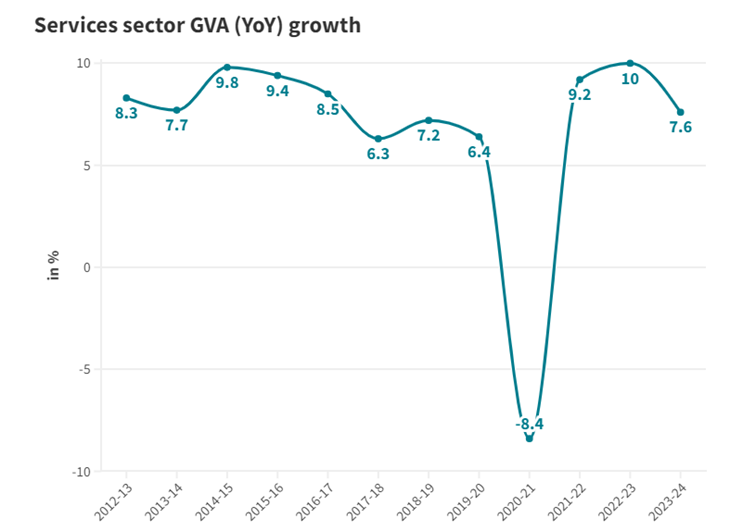

Chapter 11: Services - Fuelling Growth Opportunities

- Sector Contribution:

- 55% of overall Gross Value Added (GVA)

- 65% of active companies (16,91,495 as of 31 March 2024)

- Sector Growth: Estimated to have grown by 7.6% in FY24.

- PMI Performance: Services PMI above 50 since August 2021, indicating continuous expansion for 35 months.

- Global Services Exports:

- 4.4% of world's commercial services exports in 2022

- Computer and business services: 73% of India's services exports (9.6% YoY growth in FY24)

- Digital Services:

- 6.0% share in global digitally delivered services exports (up from 4.4% in 2019)

- Aviation Sector:

- 15% YoY increase in total air passengers handled in FY24

- 7% YoY increase in air cargo handled (33.7 lakh tonnes in FY24)

- Financial Services:

- Outstanding services sector credit: ₹45.9 lakh crore (March 2024)

- 22.9% YoY growth

- Railways:

- 5.2% increase in passenger traffic originating in FY24

- 5.3% increase in revenue-earning freight in FY24

- Tourism:

- Over 92 lakh foreign tourist arrivals in 2023 (43.5% YoY increase)

- Real Estate:

- Highest residential sales since 2013 (33% YoY growth)

- 4.1 lakh units sold in top eight cities

- Global Capability Centres (GCCs):

- Grown from over 1,000 centres in FY15 to more than 1,580 in FY23

- E-commerce:

- Expected to cross USD 350 billion by 2030

- Telecommunications:

- Tele-density increased from 75.2% (March 2014) to 85.7% (March 2024)

- Internet density increased to 68.2% (March 2024)

- 6,83,175 km of Optical Fibre Cable laid, connecting 2,06,709 Gram Panchayats

Chapter 12: Infrastructure – Lifting Potential Growth

- Public Sector Investment:

- Pivotal role in funding large-scale infrastructure projects

- National Highways:

- Average construction pace increased from 11.7 km/day (FY14) to 34 km/day (FY24)

- Railways:

- 77% increase in capital expenditure over past 5 years

- Significant investments in new lines, gauge conversion, and doubling

- Introduction of Vande metro trainset coaches planned for FY25

- Airports:

- 21 new terminal buildings operationalized in FY24

- Increased passenger handling capacity by 62 million per annum

- Logistics Performance:

- Improved rank in International Shipments category: 22nd in 2

Chapter 13: Climate Change and India: Why We Must Look at the Problem Through Our Lens

- Global Climate Change Strategies:

- Current global strategies are flawed and not universally applicable

- Western approach doesn't address the root problem of overconsumption

- Need for Approaches:

- One-size-fits-all approach is ineffective

- Developing countries need freedom to choose their own pathways

- India's Ethos:

- Emphasizes harmonious relationship with nature

- Contrasts with culture of overconsumption in developed world

- Sustainable Housing:

- Shift towards 'traditional multi-generational households' proposed as pathway to sustainable housing

- Mission LiFE:

- Focuses on human-nature harmony

- Promotes mindful consumption over overconsumption

- Addresses root cause of global climate change problem

- Critique of Western Approach:

- Does not seek to address overconsumption

- Instead focuses on substituting means to achieve overconsumption

Must Check: Best IAS Coaching In Delhi

UPSC Prelims Result 2024 Out: Expected Cut Off & Other Details, UPSC Prelims 2024 Answer with Explanation, Daily Prelims Quiz, Daily Current Affairs, MONTHLY CURRENT AFFAIRS TOTAL (CAT) MAGAZINE, Best IAS Coaching Institute in Karol Bagh, Best IAS Coaching Institute in Delhi, Daily Mains Question Answer Practice, ENSURE IAS UPSC Toppers, UPSC Toppers Marksheet, Previous Year Interview Questions, UPSC Syllabus

PLFS 2025: Monthly Jobs Data, Bigger Survey

PLFS 2025: Monthly Jobs Data, Bigger Survey