Context

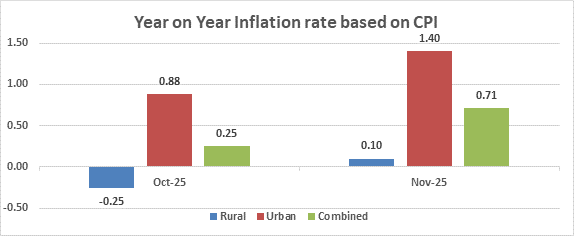

India’s retail inflation (CPI) increased slightly to 0.71% in November 2025, up from 0.25% in October, which was the lowest ever. Despite this rise, inflation remains well below the RBI’s target of 4% and below the lower limit of 2% for several months, shaping expectations about future interest rate cuts.

What is CPI Inflation?

- Consumer Price Index (CPI) inflation measures the year-on-year change in prices of goods and services commonly used by households.

- It reflects the cost of living and is the main inflation indicator used by the RBI for monetary policy.

Key terms

- Headline inflation: The overall rate of inflation measured by CPI, showing the change in prices of all goods and services consumed by households.

- Food inflation: The rate at which prices of food items in the CPI basket change over time, strongly affecting household cost of living.

- Core inflation: Inflation calculated after removing food and fuel prices to capture underlying, more stable price pressures in the economy.

- Deflation: A situation where inflation turns negative, meaning overall prices are lower than in the same period of the previous year.

Why Inflation Remained Very Low in November?

- The slight rise in November inflation happened mainly due to a base effect, not because prices suddenly rose sharply.

- In October 2025, prices were unusually low

- When compared to that low base, November inflation appears slightly higher

- Even then, overall inflation stayed extremely low

- This shows that price pressures remain weak in the economy.

How Food Prices Shaped Inflation?

- Food prices have been the main reason for low inflation in recent months.

- Food inflation was negative for the sixth straight month

- In November, food prices were 91% lower than last year

- This was slightly less negative than October, when food deflation was 02%

- Reasons for food deflation:

- Vegetables and pulses saw large price declines.

- Cereals inflation fell to a 50-month low, helped by a good Kharif harvest.

- Month-to-month:

- Food prices rose slightly compared to October.

- But year-on-year prices remained lower.

- So, food inflation is still pulling overall inflation down, though less strongly than before..

What Happened to Non-Food Prices?

- Prices outside food remained largely stable, showing no major pressure.

- Clothing, housing, fuel and services rose only marginally

- Overall price momentum in non-food items stayed subdued

- This indicates weak demand conditions in the economy.

Why Did Core Inflation Not Fall Further?

- Core inflation stayed around 4.4%, instead of falling further.

- Main reason:

- Gold and silver prices rose sharply to record highs.

- Though gold and silver have very small weight in CPI, their extreme price rise pushed inflation up.

- At the same time:

- The impact of GST rate cuts implemented earlier helped reduce inflation in other goods.

- Thus:

- Precious metals pushed inflation up.

- Tax cuts pushed inflation down.

- Net effect: core inflation remained stable.

RBI’s Monetary Policy Perspective

- Inflation has stayed below 4% for 10 consecutive months

- It has remained below 2% for three months in a row

- Average inflation so far this year is below RBI’s forecast

- The RBI expects inflation to:

- Rise gradually in coming quarters

- Remain close to the 4% target, not exceed it

- Because:

- Food prices remain benign

- Underlying inflation pressures are weak

- Economic growth is slowing

- This creates space for another interest rate cut.

Implications

- Low inflation supports household purchasing power

- Food deflation eases pressure on poor households

- Stable core inflation suggests no overheating

- RBI gets room to focus on growth

- Lower interest rates can support investment and consumption

Challenges and Way Forward

| Challenges | Way Forward |

| Inflation depends heavily on food prices | Strengthen agriculture and supply chains |

| Precious metals distort inflation readings | Focus more on underlying core trends |

| Inflation may rise later due to base effects | Maintain cautious, forward-looking policy |

| Growth slowdown alongside low inflation | Use calibrated rate cuts to support demand |

Conclusion

India’s inflation remains very low due to sustained food deflation and weak demand. While inflation may rise gradually, underlying pressures are limited, giving the RBI room to support growth without risking price stability.

| Ensure IAS Mains Question

Q. Explain the recent trends in CPI inflation in India. How have food prices and core inflation influenced the RBI’s monetary policy stance? |

| Ensure IAS Prelims Question

Q. Consider the following statements: 1. Sustained food deflation can pull headline CPI inflation below the RBI’s target even when core inflation remains moderate. 2. A sharp rise in prices of items with very small weight in the CPI basket can still influence headline inflation. 3. Core inflation is completely unaffected by changes in indirect taxes such as GST. Which of the statements are correct? a) 1 and 2 only b) 2 and 3 only c) 1 and 3 only d) 1, 2 and 3 Answer: a) 1 and 2 only Explanation Statement 1 is correct: Food has a large weight in the CPI basket. Sustained food deflation can significantly reduce headline inflation even if core inflation remains relatively stable. Statement 2 is correct: Even items with small weights can affect headline inflation if their price increase is extremely high, as seen with sharp rises in gold and silver prices. Statement 3 is incorrect: Indirect tax changes like GST cuts or hikes affect prices of non-food items and can influence core inflation. |

|

Also Read |

|

| UPSC Foundation Course | UPSC Daily Current Affairs |

| UPSC Monthly Magazine | CSAT Foundation Course |

| Free MCQs for UPSC Prelims | UPSC Test Series |

| Best IAS Coaching in Delhi | Our Booklist |