Why in the News?

- China’s electric vehicle (EV) industry is experiencing a phenomenon known as “involution”, where excessive competition and price wars push firms into losses.

- Trade tariffs imposed by the U.S., EU, Turkiye, and Mexico have intensified domestic pressures in China’s EV market.

- President Xi Jinping and the Chinese government have initiated policy and regulatory measures to curb this “disorderly competition.”

Key Highlights

- Concept of Involution

- Derived from the Latin involūtiōn-em meaning “to turn inward.”

- Popularised by anthropologist Clifford Geertz in 1969 to describe stagnating productivity despite rising effort.

- In China’s context: price wars where oversupply, excessive competition, and below-cost selling hurt profitability.

- Manifestation in the EV Sector

- Over 120–130 EV makers in China competing aggressively.

- Price cuts so deep that retail prices fall below production costs.

- Industry leaders themselves term this unsustainable trend as “involution.”

- Global Trade Dynamics Intensifying the Crisis

- S. Section 301 tariffs: 100% on Chinese EVs, creating a de facto trade embargo.

- EUs: Turkiye (40%) and Mexico (50%) also raised tariffs to block Chinese import

- Result: Chinese OEMs (BYD, Geely, SAIC) push harder into the domestic market, worsening competition.

- China’s Response to Price Wars

- May 31, 2025: MIIT assured steps against “involution.”

- June 30, 2025: Politburo communication framed as Xi’s “war on price wars.”

- July 24, 2025: Draft overhaul of pricing law – targeting below-cost selling and algorithmic abuses.

- Xi Jinping’s Qiushi article (Aug 2025): Called for curbing “disorderly price competition” and enabling “orderly exit” of outdated capacity.

- Shifts in Strategy by Chinese OEMs

- Localisation abroad: Factories in Hungary, Turkiye, etc.

- Diversifying exports: Strong presence in emerging markets (75% of EV sales growth outside China in 2024).

- Consolidation risk: Many small players may be forced to exit due to financial strain.

Implications

- For the Chinese Economy

- Risk of mass consolidation, job losses, and social discontent if smaller EV players collapse.

- Strain on China’s industrial overcapacity, reminiscent of the solar sector crisis.

- For Global Trade

- Growing protectionism against Chinese EVs from U.S., EU, Turkiye, and Mexico.

- Potential escalation of trade tensions, especially in green technology sectors.

- For Global EV Market

- Short-term: Lower EV prices in China, benefiting consumers but hurting sustainability of firms.

- Long-term: Fewer but stronger Chinese players dominating international EV markets.

- For Europe and the U.S.

- European carmakers under existential threat due to cheaper, technologically superior Chinese EVs.

- S. relying on tariffs rather than domestic competitiveness risks long-term market stagnation.

- For Emerging Markets

- Benefiting from affordable Chinese EVs (75% of EV sales growth in 2024 came from Chinese imports).

- Risk of dependence on Chinese supply chains if local industries fail to develop.

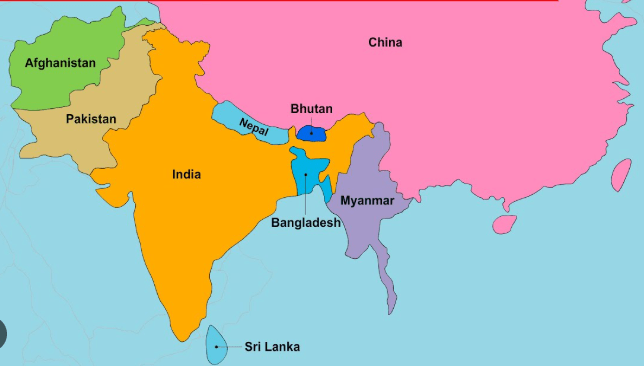

- Implications for India

- Market Opportunities

- With U.S. and EU shutting out Chinese EVs through tariffs, India could attract more affordable EV models, either via direct imports or local manufacturing by Chinese OEMs.

- This may accelerate EV adoption in India by lowering consumer costs.

- Domestic Industry Pressure

- Cheaper Chinese EVs could outcompete Indian firms such as Tata Motors, Mahindra, and startups unless India strengthens tariff barriers and incentivises local R&D.

- Similar challenges were seen in the Indian solar sector, where Chinese imports dominated.

- FDI and Manufacturing Prospects

- Chinese EV makers (like BYD) may consider local assembly plants in India to bypass tariff restrictions elsewhere.

- This can boost job creation and localisation, but it raises strategic concerns about dependence on China.

- Strategic Trade Positioning

- India can use the global EV reshuffle to position itself as an alternative supply hub for Western markets seeking to diversify away from China.

- Leveraging initiatives like the PLI scheme for Advanced Chemistry Cell (ACC) batteries and FAME-II, India could attract investment from non-Chinese OEMs too.

- Energy Transition Advantage

- Increased inflow of competitively priced EVs (whether Chinese or joint-venture based) supports India’s net-zero 2070 goals and reduces reliance on fossil fuels.

- At the same time, India must balance affordability with long-term self-reliance in EV technology.

- Market Opportunities

Conclusion

The phenomenon of “involution” in China’s EV sector highlights the paradox of rapid industrial growth leading to internal economic stress. While tariffs from Western economies have worsened the crisis, the root problem lies in unsustainable competition and overcapacity. The Chinese government’s crackdown on price wars and push for structural reforms could stabilise the industry. However, the challenge is balancing domestic consolidation with global expansion, ensuring that China remains the central player in the global EV transition without triggering deeper trade conflicts.

| EnsureIAS Mains Question

Q. The phenomenon of “involution” in China’s EV sector reflects both internal structural challenges and external trade pressures. Discuss its implications for the global electric vehicle industry. (250 words) |

| EnsureIAS Prelims Question Q. Consider the following statements regarding “Involution” in China’s EV sector: 1. The term involution was popularised by American anthropologist Clifford Geertz in the context of agriculture. 2. It refers to a process where increasing effort and complexity lead to proportional increases in productivity and income. 3. In China, the term describes intense price wars among EV manufacturers, often leading to below-cost selling. Which of the above statements is/are correct? a) 1 and 2 only Answer: b) 1 and 3 only |

|

Also Read |

|

| UPSC Foundation Course | UPSC Daily Current Affairs |

| UPSC Monthly Magazine | CSAT Foundation Course |

| Free MCQs for UPSC Prelims | UPSC Test Series |

| ENSURE IAS NOTES | Our Booklist |