- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

CARBON BORDER ADJUSTMENT MECHANISM (CBAM)

CARBON BORDER ADJUSTMENT MECHANISM (CBAM)

11-05-2023

Latest Context

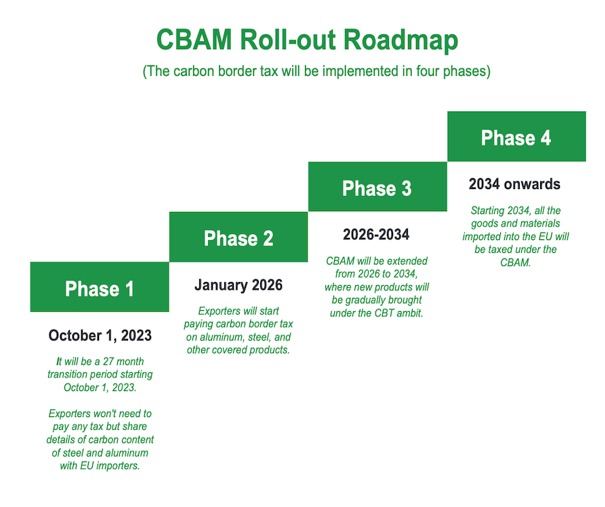

The European Union (EU) has announced that its Carbon Border Adjustment Mechanism (CBAM), which would impose a carbon tax on imports of goods created by non-green or environmentally unsustainable techniques, will be adopted in its transitional phase from October 2023.

- Beginning on January 1, 2026, the CBAM will be interpreted as a 20–35% tax on a limited number of goods entering the EU.

Key Points of CBAM

- CBAM is a component of the "Fit for 55 in 2030 package," which is the EU's strategy to comply with the European Climate Law by cutting greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels.

- By guaranteeing that imported commodities bear the same carbon costs as items made in the EU, the CBAM is a policy measure intended to lower carbon emissions.

- Objectives: In order to prevent imports with a high carbon footprint from undermining its climate goals, CBAM will also encourage cleaner manufacturing elsewhere in the globe.

- Implementation: In order to implement the CBAM, importers will have to annually disclose the volume of commodities they import into the EU and their associated Greenhouse Gas (GHG) emissions.

- Importers must surrender a matching number of CBAM certificates, the cost of which will be determined by the weekly average auction price of EU Emission Trading System (ETS) permits in euros per tonne of CO2 emitted, in order to offset these emissions.

- Significance: It may persuade non-EU nations to enact stricter environmental laws, which would cut down on global carbon emissions.

- The revenue obtained through CBAM will be used to fund EU climate policy, which other nations can utilise to promote green energy.

Impacts on India

- India’s Export: Due to the mechanism's increased inspection, it would have a negative effect on India's exports of metals including iron, steel, and aluminium goods to the EU.

- The EU will begin collecting the carbon tax on each shipment of steel, aluminium, cement, fertiliser, hydrogen, and energy on January 1, 2026.

- Carbon Intensity and Higher Tariffs: Due to coal's dominance in global energy consumption, Indian products have a far greater carbon intensity than those from the EU and many other nations.

- India generates close to 75% of its electricity from coal, which is far more than the EU (15%) or the world average (36%).

- Risk to Export Competitiveness: It will first impact a small number of industries, but it might later spread to others. For example, textiles, organic chemicals, pharmaceuticals, and refined petroleum products are among the top 20 goods the EU imports from India.

What steps India can take to Mitigate the Impact of CBAM?

- Decarbonization Principle: Domestically, the government has schemes like the National Steel Policy and the Production Linked Incentive (PLI) scheme aims to boost India's

production capacity, but carbon efficiency hasn't been one of their stated goals.

production capacity, but carbon efficiency hasn't been one of their stated goals.

- Decarbonization: The process of lowering or eliminating greenhouse gas emissions, particularly carbon dioxide (CO2), from human activities including transportation, energy production, industry, and agriculture is known as decarbonization.

- Negotiation with EU for Tax Reduction: Indian exports would be less vulnerable to CBAM if the EU agreed to recognise India's energy taxes as equivalent to a carbon price. For example, India could argue that its tax on coal is a measure to internalize the costs of carbon emissions, and therefore equivalent to a carbon tax.

- Transfer of Clean Technologies: To assist in making India's industrial sector more carbon-efficient, India could engage with the EU to transfer clean technology and finance frameworks.

- Incentivizing Greener Production: By encouraging cleaner manufacturing, India can start making plans and really take the chance to make production more environmentally friendly and sustainable. This would help India stay competitive in a future where people are increasingly concerned about the environment.

- Take on EU’s Tax Framework: India could utilise its position as the G-20's 2023 head to promote other nations and persuade them to oppose the EU's carbon price system

Conclusion

- The CBAM is an initiative to cut down on carbon emissions from imported goods and promote fair trade.

- It can encourage other countries to have stricter environmental regulations and reduce global carbon emissions.

Must Check: IAS Coaching Centre In Delhi