- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- Online Program

- GS Recorded Course

- NCERT (Recorded 500+ Hours)

- Polity Recorded Course

- Geography Recorded Course

- Economy Recorded Course

- AMAC Recorded Course

- Modern India, Post Independence & World History

- Environment Recoded Course

- Governance Recoded Course

- Science & Tech. Recoded Course

- International Relations and Internal Security Recorded Course

- Disaster Management Module Course

- Ethics Recoded Course

- Essay Recoded Course

- Current Affairs Recoded Course

- ABOUT US

- OUR TOPPERS

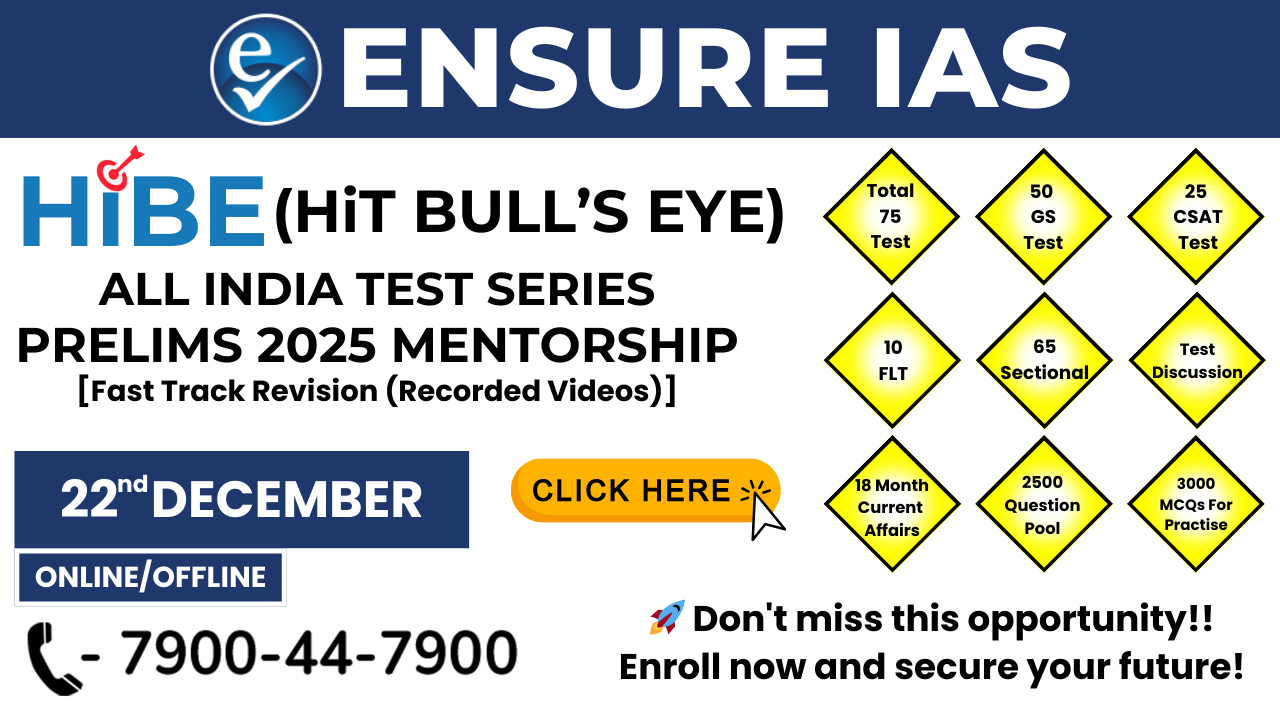

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Banks Report Spike in Bad Loans in Personal Loans and Credit Cards

Banks Report Spike in Bad Loans in Personal Loans and Credit Cards

19-12-2024

- In December 2024, Indian banks celebrated their success in reducing Non-Performing Assets (NPAs) across the sector over the last two years, but a closer look at specific segments reveals a concerning trend.

- The personal loans and credit card segments have seen a significant spike in NPAs, coinciding with a rising level of borrower indebtedness.

- This growing debt burden is casting a shadow over the banking sector's progress in reducing NPAs.

What is an NPA?

Types of NPAs:

|

Personal Loan NPAs: Significant Increase

- The NPAs in the personal loans segment rose sharply by 51% from Rs 7,422 crore (0.93% of advances) in March 2023 to Rs 11,210 crore (1.16% of advances) by June 2024.

- In the three months between March 2024 and June 2024, the NPAs increased by Rs 1,522 crore, from Rs 9,688 crore to Rs 11,210 crore.

- Despite the rise in NPAs in personal loans, banks have been successful in reducing gross NPAs across the banking sector.

- Gross NPAs decreased from Rs 6.97 lakh crore (5.89% of advances) in March 2022 to Rs 4.56 lakh crore (2.79% of advances) by March 2024.

Credit Card NPAs: A Drastic Surge

- Credit card NPAs have surged by 136% from Rs 2,404 crore (1.82% of advances) in March 2020 to Rs 5,679 crore (2.04% of advances) by June 2024.

- From March 2023 to June 2024, credit card NPAs rose by 39.46%, from Rs 4,072 crore to Rs 5,679 crore.

- Both personal loans and credit card debt are unsecured loans, which means they do not require collateral.

- They also carry high-interest rates, making them riskier for borrowers.

- If a borrower delays repayment of their credit card bill, interest rates of 42-46% per annum are charged, which can quickly lead to debt accumulation.

Reasons Behind the Rise in NPAs

- Rising borrower indebtedness is a significant factor contributing to the increase in NPAs.

- As borrowers struggle to repay their loans due to high interest rates and mounting debt, defaults become more common.

- In November 2023, the RBI increased the risk weights for banks' exposure to consumer credit, credit card receivables, and non-banking finance companies (NBFCs) by 25% up to 150%.

- This was done to mitigate risks in these segments.

- While demand for consumer credit remains strong, the increase in risk weights has slowed the growth rate of consumer credit, particularly in personal loans and credit cards.

- The unsecured business loans segment has started showing early signs of stress due to increasing competition among lenders, cash flow pressure on certain borrowers, higher write-offs, and overleveraging.

- This has added additional strain to asset quality in these segments, according to India Ratings.

Credit Card Usage and Outstanding Balance

- The value of credit card transactions has tripled over the past three years.

- It rose from Rs 6.30 lakh crore in March 2021 to Rs 18.31 lakh crore in the year ending March 2024.

- Between March 2021 and March 2023, the value of credit card transactions increased from Rs 6.30 lakh crore to Rs 14.32 lakh crore.

- The monthly spend on credit cards has also increased dramatically, rising from Rs 72,319 crore in March 2021 to Rs 1.76 lakh crore in September 2024.

- The number of credit cards issued has increased significantly, from 6.20 crore in March 2021 to 10.61 crore by September 2024.

- In just one year, from September 2023 to September 2024, the number of credit cards issued grew from 9.3 crore to 10.61 crore.

Rising Credit Card Outstanding Balance

- The outstanding credit card balance — the amount due after the interest-free period — has risen to Rs 281,392 crore by October 2024, compared to Rs 249,635 crore in 2022.

- As more people rely on credit cards for purchases, the outstanding balance has increased, leading to greater financial pressure on borrowers who are unable to repay within the interest-free period.

Incentives Behind the Rise in Credit Card Usage

- Banks have attracted customers to credit cards through various incentives, such as rewards for higher spending, loan offers, and lounge access benefits.

- However, many customers fail to realize the consequences of carrying outstanding dues.

- If they fail to pay off their credit card bills within the interest-free period, they can face interest rates as high as 42%.

- Bank officials have warned that if borrowers delay credit card payments beyond the interest-free period, they can fall into a debt trap, paying up to 42% interest, which can spiral out of control and lead to long-term financial distress.

Steps Taken to Curb NPAs

- Debt Recovery Tribunal (DRT)

- Set up: 2013.

- Purpose: To reduce the time taken for settling loan recovery cases. It helps resolve disputes between lenders (like banks) and borrowers more efficiently.

- Law: Governed by the Recovery of Debt due to Banks and Financial Institutions Act, 1993. The law allows banks to take quick legal action against defaulters.

- Credit Information Bureau

- Set up: 2000.

- Purpose: To prevent the rise of NPAs by maintaining and sharing information on willful defaulters (borrowers who intentionally avoid paying their debts). This helps lenders assess the risk of lending to a borrower.

- How it works: By sharing credit history, banks and financial institutions can make informed decisions and avoid lending to high-risk borrowers.

- Asset Reconstruction Companies (ARCs)

- Purpose: To recover value from stressed loans. ARCs buy bad loans from banks, manage them, and attempt to recover the loan amount by restructuring or selling the assets. This helps banks get rid of NPAs and focus on fresh lending.

- Advantage: ARCs bypass lengthy court proceedings, speeding up recovery.

- SARFAESI Act, 2002

- Full Name: Securitization and Reconstruction of Financial Assets and Enforcement of Security Interests Act.

- Purpose: This law gives banks and financial institutions the power to seize immovable property (like land, buildings) pledged as security without needing to go through the Debt Recovery Tribunal (DRT).

- How it helps: It enables quicker asset recovery, allowing banks to sell the seized property to recover outstanding loans.

- Corporate Debt Restructuring (CDR)

- Launched: 2005.

- Purpose: To help distressed companies by restructuring their debt. The restructuring may include extending the loan repayment period or reducing interest rates, making it easier for companies to repay their loans.

- Goal: To reduce the likelihood of default and avoid NPAs.

- 5:25 Rule

- Introduced: 2014.

- Purpose: Specifically designed for infrastructure and core industries. It allows the restructuring of long-term loans where the repayment period can extend beyond 25 years, with flexibility in repayment terms.

- How it works: It helps ensure that companies in these sectors don't default on loans, thus preventing them from turning into NPAs.

- Joint Lenders Forum (JLF)

- Set up: 2014.

- Purpose: The JLF is a forum where multiple lenders (banks or financial institutions) come together to jointly discuss and resolve issues when a borrower is facing repayment difficulties.

- Why it's needed: It prevents situations where a borrower takes loans from multiple banks and uses funds from one bank to repay loans from another (a practice called "evergreening"). The JLF encourages collective action to recover loans.

- Mission Indradhanush

- Launched: 2015.

- Purpose: A set of 7 reforms designed to improve the functioning of Public Sector Banks (PSBs), aiming to reduce NPAs and improve financial health.

- Key Reforms:

- Appointments: Improve leadership by selecting the right people for top management positions.

- Bank Board Bureau: Establishment of a central body to guide bank governance.

- Capitalization: Infuse capital into PSBs to strengthen their financial position.

- De-stressing: Addressing stressed assets (NPAs) through restructuring.

- Empowerment: Giving banks more operational freedom to manage NPAs.

- Accountability: Ensuring better oversight and responsibility for performance.

- Governance Reforms: Improving transparency and governance in banks.

- Strategic Debt Restructuring (SDR)

- Launched: 2015.

- Purpose: If a company is unable to repay its loans, banks can convert part or all of the loan amount into equity shares. This means the banks take a stake in the company rather than just waiting for repayment.

- How it works: This helps distressed companies get financial relief while allowing banks to recover their dues by taking ownership in the company.

- Asset Quality Review (AQR)

- Introduced: 2015.

- Purpose: A proactive measure by the Reserve Bank of India (RBI) to identify potential NPAs early by reviewing the quality of assets on banks' balance sheets.

- Goal: To ensure that banks identify and address stressed assets before they turn into bad loans, improving the financial health of the banking system.

- Insolvency and Bankruptcy Code (IBC)

- Enacted: 2016.

- Purpose: To streamline and speed up the process of resolving insolvencies and bankruptcies. It provides a clear legal framework for companies facing default and allows creditors to recover dues more quickly.

- How it works: The IBC sets a time-bound process for resolving insolvencies, ensuring that banks and other creditors can recover their money in a fixed period (typically 180 days). It also allows for the liquidation of assets if necessary.

- Bad Bank

- Concept: A Bad Bank is a specialized Asset Reconstruction Company (ARC) that buys NPAs from banks and restructures them.

- Purpose: By separating bad loans from healthy loans, the Bad Bank helps reduce the burden on the regular banking system. It can focus on restructuring and recovering value from these NPAs, while the original banks can focus on fresh lending.

| Also Read | |

| UPSC Prelims Result | UPSC Daily Current Affairs |

| UPSC Monthly Mgazine | Previous Year Interview Questions |

| Free MCQs for UPSC Prelims | UPSC Test Series |

| ENSURE IAS NOTES | Our Booklist |