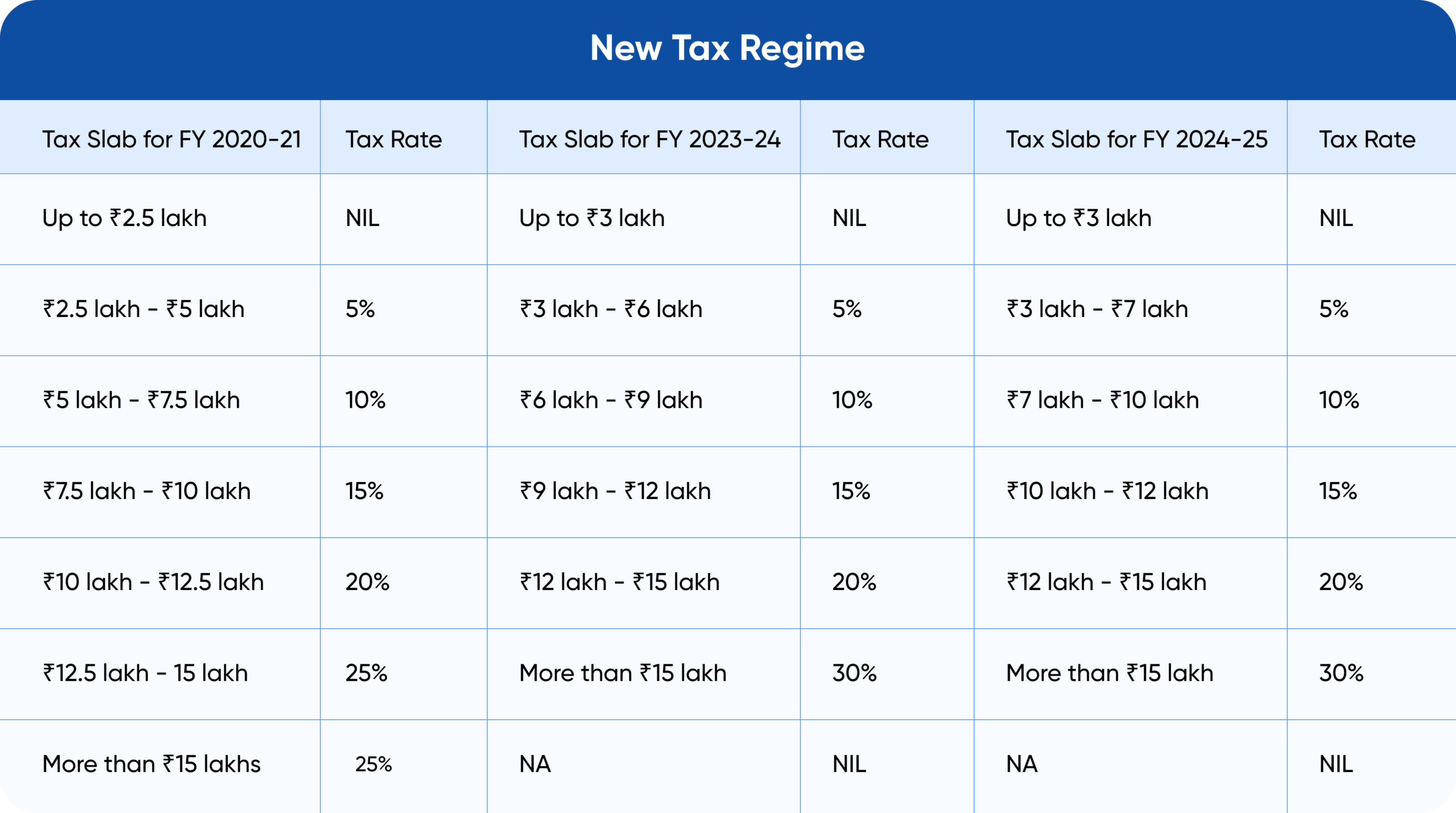

In the Union Budget 2026-27, the Government of India has focused on simplifying tax compliance and providing relief to middle-income earners. A major highlight is the implementation of the New Income Tax Act, 2025, which officially replaces the decades-old Income Tax Act of 1961 starting April 1, 2026

The Indian income tax system follows a progressive model where higher income attracts a higher tax percentage. For the Financial Year (FY) 2026-27, the government has continued the “New Tax Regime” as the default option.

Starting from April 2026, the tax process becomes much simpler under the New Income Tax Act, 2025. The number of sections has been reduced from over 700 to 536, making the law easier to understand for everyone.

Key Highlights for 2026:

- Zero Tax up to ₹12 Lakh: Due to an enhanced tax rebate under Section 87A, individuals with a taxable income of up to ₹12 lakh do not have to pay any income tax.

- Standard Deduction: Salaried individuals get a fixed deduction of ₹75,000. This means if the total salary is ₹12.75 lakh, the taxable income becomes ₹12 lakh, resulting in zero tax.

- Default Regime: The New Tax Regime is the primary choice for taxpayers, though the Old Regime remains an option for those who want to claim specific deductions like HRA or LIC (80C).

New Income Tax Slab Features

The updated regime is designed to be “taxpayer-friendly” with several features that reduce the calculation burden:

- Higher Exemption Limit: The basic exemption limit is now ₹4 lakh (increased from ₹3 lakh previously). This means the first ₹4 lakh of income is not taxed at all.

- Simplified Structure: By removing most complex exemptions, the government has kept the tax rates lower compared to the Old Regime.

- Extended Revision Window: Taxpayers now have until March 31 to revise their tax returns, providing three extra months to fix any errors.

- Reduced TCS Rates: Tax Collected at Source (TCS) on foreign travel and education has been slashed to a flat 2%, providing relief to students and travelers.

New Income Tax Slab Rates

The following table shows the tax rates for the New Tax Regime applicable for FY 2026-27 (Assessment Year 2027-28):

| Income Range (₹) | Tax Rate (%) |

| Up to ₹4,00,000 | NIL |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Note: A 4% Health and Education Cess is added to the final tax amount calculated.

New Tax Regime vs Old Tax Regime

Choosing between the two regimes depends on your investments and salary structure. Here is a clear comparison:

| Feature | New Tax Regime (Default) | Old Tax Regime (Optional) |

| Basic Exemption | ₹4 Lakh | ₹2.5 Lakh (for most) |

| Tax Rebate (87A) | Up to ₹12 Lakh income | Up to ₹5 Lakh income |

| Standard Deduction | ₹75,000 | ₹50,000 |

| Investment Benefits | Not available (No 80C, 80D, etc.) | Available (LIC, PPF, Health Insurance) |

| NPS Benefit | Employer’s contribution up to 14% | Employer’s + Employee’s contribution |

| Simplicity | High – No proof of investment needed | Low – Requires careful tax planning |

Which one should you choose?

- Choose the New Regime if you do not have many investments and want lower tax rates with zero paperwork. It is especially beneficial for those earning up to ₹12.75 lakh (salaried).

- Choose the Old Regime if you have heavy investments in home loans, insurance, and ELSS funds that exceed the benefits provided by the lower rates of the new system.