Context

India ended 2025 with strong macroeconomic stability despite external shocks, but weak domestic consumption has emerged as a key challenge for 2026, threatening private investment and future growth.

1. What was expected at the beginning of 2025 regarding US tariffs and US trade deal?

- At the start of 2025, policymakers broadly believed that India would remain largely insulated from the tariff actions initiated by the United States and would conclude an early trade deal with the US.

- There was confidence that India’s domestic economic strength would cushion any external disruption.

- However, as the year progressed, both assumptions proved incorrect.

2. What external shock did India face during 2025 in the form of tariffs and H-1B Visa norms?

- In 2025, the US administration imposed a 25% reciprocal tariff on Indian goods and later added an additional 25% penalty due to India’s purchase of Russian crude oil.

- As a result, India faced the highest effective tariffs into the US, even higher than China.

- At the same time, a tightening of H-1B visa norms affected India’s services exports.

- This created a two-pronged shock, hitting both goods exports through tariffs and services exports through visa restrictions.

- Initially, there were serious concerns that India’s export engine would stall but this did not happen.

3. Why did India’s exports not collapse despite high tariffs?

- Although exports declined between September and October 2025, a strong recovery was seen in November.

- This recovery was driven by higher exports of tariff-exempt goods, particularly pharmaceuticals and electronics, and by Indian exporters successfully diversifying into alternative global markets.

- As a result, the impact of tariffs turned out to be less damaging than feared, even though the external environment remained hostile.

4. How did the domestic economy perform during 2025 with low inflation and low interest rates?

- Despite external pressures, the domestic economy showed steady performance.

- Indian businesses recorded stable growth in recent quarters, and the economy closed 2025 with low inflation and low interest rates.

- This domestic stability acted as a buffer, preventing external shocks from triggering a broader economic slowdown.

5. How did the government respond during 2025 with reforms like GST rationalization, labour reforms and financial sector reforms?

- The government used the crisis period to push through several reforms, despite concerns that reform momentum had slowed after the 2024 general election.

- In the second half of the year, policy actions included GST rate rationalisation, progress on long-pending labour law reforms, and amendments to the nuclear sector aimed at attracting private and foreign investment, even though this involved diluted supplier liability provisions.

- In the financial sector, reforms such as 100% foreign ownership in insurance and new investment norms for banks and pension funds were introduced to attract foreign capital amid concerns over capital outflows and a widening current account deficit (CAD).

- Other significant steps included a reduction in MGNREGA spending, which weakened the rural safety net, and the withdrawal of several Quality Control Orders (QCOs) that had burdened smaller firms in sectors such as textiles and steel.

6. What role did capital flows and the rupee play?

- Towards the end of 2025, India saw a late surge in foreign direct investment, led by commitments from global technology firms in cloud and AI infrastructure.

- This helped ease concerns about capital flows.

- The rupee depreciated to over ₹90 per US dollar, and this managed depreciation provided partial relief to exporters facing a 50% tariff barrier in the US.

- Together, these factors helped India weather the tariff shock without a financial crisis.

7. What is the domestic outlook for 2026 with GDP growth forecast at 7.3% in FY26?

- India continues to be the fastest-growing major economy, with GDP growth forecast at 3% in FY26.

- High-frequency indicators suggest that economic activity remained resilient in the October–December quarter of 2025.

- Agricultural growth has been supportive, aided by a healthy kharif harvest and improved rabi sowing.

- The Chief Economic Adviser has indicated that growth in 2025–26 is expected to be at least 7%.

- However, early signs of weakness are emerging in some indicators.

8. Where is the main weakness emerging?

- The central weakness lies in domestic consumption.

- Rural demand remains relatively strong, but urban consumption is still recovering.

- Festival spending and GST changes supported demand temporarily, but it is uncertain whether this momentum will continue.

- Private investment has shown mild improvement, supported by higher non-food bank credit and rising capacity utilisation.

- However, utilisation remains at 75–77%, while companies typically require around 80% for several quarters before committing to major new investments.

- Without stronger consumption demand, private investment is unlikely to accelerate sustainably.

9. What are the key external risks going forward?

- Externally, uncertainty remains high.

- There is still no clarity on how long US tariffs will continue, and global trade conditions remain weak.

- There is also a risk that Chinese exports, blocked from the US market, may be redirected to other regions, including India, increasing competition for Indian producers.

- The AI boom in the US is hiding deeper economic weaknesses. Although technology-driven growth looks strong, the US labour market has weakened, which may slow the economy over time.

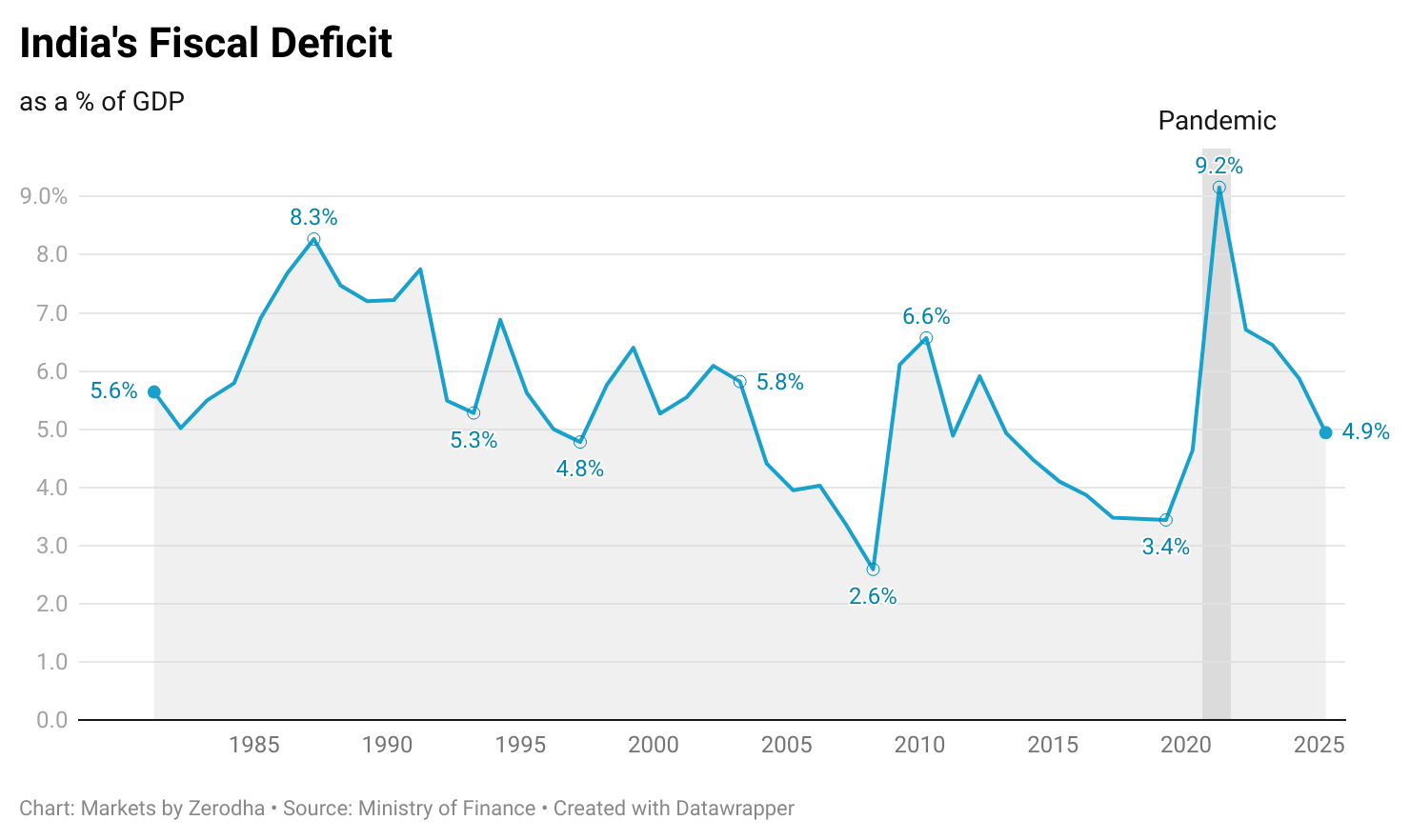

- At the same time, many developed countries have high debt and fiscal deficits. To reduce this burden, governments may allow higher inflation to erode the real value of debt, a process known as inflating away debt.

- If this happens, it could create global market instability, affecting countries like India.

10. Why is consumption critical for India’s long-term growth?

- According to a World Bank report, India must grow at an average of 8% for over two decades to reach high-income status by 2047.

- Historically, India’s trend growth has been 6–7%, with near-8% growth achieved only briefly during FY03–08.

- India’s most reliable growth engine has been domestic consumption, which can revive private investment and attract FDI.

- However, weak demand visibility is discouraging companies from expanding capacity.

- At the same time, rising capital productivity relative to labour productivity raises concerns about how growth benefits will be distributed.

- India’s new labour codes are only a small initial step in addressing this challenge.

11. What is the way forward to revive consumption and sustain growth?

- India must focus on reviving domestic consumption, especially urban demand, to provide confidence for private investment.

- Policy must balance fiscal prudence with targeted support to boost demand, while continuing structural reforms that improve productivity and employment.

- Externally, India should accelerate trade negotiations with the EU and other partners to reduce tariff dependence on the US.

- Strengthening services exports, remote work opportunities, and skill development will be crucial in an AI-driven global economy.

Conclusion

India successfully weathered severe tariff shocks in 2025 due to domestic stability, reform efforts, and capital inflows. However, the sustainability of growth now depends on reviving domestic consumption to drive private investment. Without this, external uncertainties, weak demand, and global disruptions could constrain India’s economic momentum in the years ahead.

| Ensure IAS Mains Question Q. Despite weathering external tariff shocks in 2025, India faces headwinds from weak domestic consumption. Analyse the reasons for India’s resilience to external shocks and examine why reviving consumption is critical for sustaining private investment and long-term growth. (250 words) |

| Ensure IAS Prelims Question Q. With reference to India’s economic outlook in 2025-26, consider the following statements: 1. India faced higher effective tariffs in the US market than China during 2025. 2. Recovery in India’s exports to the US was partly driven by higher exports of tariff-exempt goods. 3. Capacity utilisation in India has crossed 80%, leading to a strong revival of private investment. Which of the statements given above is/are correct? [A] 1 and 2 only [B] 2 and 3 only [C] 1 and 3 only [D] 1, 2 and 3 Answer: [A] 1 and 2 only Explanation: Statement 1 is correct: In 2025, India faced the highest effective tariffs into the US, even higher than China, due to reciprocal tariffs and additional penalties. Statement 2 is correct: India’s export recovery was supported by tariff-exempt goods such as pharmaceuticals and electronics, along with market diversification. Statement 3 is incorrect: Capacity utilisation remains around 75-77%, below the level required for a strong and sustained revival of private investment. |

Also Read | |

| UPSC Foundation Course | UPSC Daily Current Affairs |

| UPSC Monthly Magazine | CSAT Foundation Course |

| Free MCQs for UPSC Prelims | UPSC Test Series |

| Best IAS Coaching in Delhi | Our Booklist |