Context

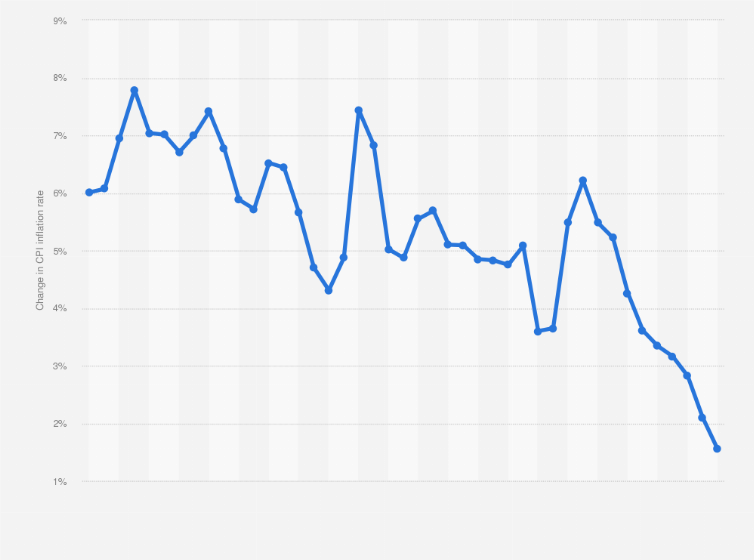

India’s retail inflation (CPI) fell to a record low of 0.25% in October 2025. Inflation has stayed below the RBI’s 4% target for nine months in a row. The Monetary Policy Committee (MPC) will now decide whether to cut the repo rate further in December or February 2026. But the headline inflation number hides several important factors such as the GST cuts, the base effect, and surging gold and silver prices.

What is CPI Inflation?

- CPI inflation measures how much consumer prices have increased compared to the same month last year.

- Formula: Inflation = % change in prices this year same month last year.

- If prices were high last year, inflation this year looks lower – this is called the base effect.

What is the Base Effect?

The base effect means inflation depends on how high or low prices were 12 months ago.

- If last year’s prices were very high, inflation this year looks lower.

- If last year’s prices were low, inflation this year looks higher.

In October 2025, the base effect was highly favourable at 133 basis points (bps), meaning inflation fell 1.33% just because last year’s prices were high.

Why Did CPI Inflation Fall So Much? (Key Reasons)

- Impact of GST Cuts

- GST rate cuts effective 22 September 2025 reduced the prices of many consumer items.

- Companies have not yet passed on the full benefit, so more price reductions may appear in the November inflation data.

- Strong Favourable Base Effect

- The base effect reduced October inflation by 133 bps, one of the strongest in 15 months.

- If prices had not moved at all in October, CPI inflation would have been just 0.1%.

- Food Base Effect Was Even Stronger

- Food makes up 39% of CPI.

- Food base effect was 256 bps, pulling food inflation down to –5.02%, a record low.

Why Will Inflation Likely Rise Soon?

- Inflation will start increasing from November because the base effect will turn unfavourable. This means that last year’s prices were low during this period, so when we compare today’s prices with those low prices, the inflation rate automatically looks higher.

- The base effect will become the most unfavourable in January 2026. In January last year, prices were especially low, so comparing this year’s prices to those low levels will push inflation up sharply.

- Because of this change in base effect, the RBI expects inflation to rise to 4.5% in April-June 2026. This is much higher than the very low 1.7% inflation seen in July-September 2025.

Should Gold and Silver be Excluded from CPI?

- Why does gold and silver affect CPI?

- CPI basket contains 299 items, including gold and silver, since households consume these metals.

- Together, they form 19% of CPI.

- What is happening now?

- Gold and silver prices have surged sharply:

- Gold inflation (Oct): +57.83%

- Silver inflation (Oct): +62.36%

- They have been in double digits for 20 months.

- Gold and silver prices have surged sharply:

- Impact of excluding them

- If gold and silver were removed from CPI, inflation in October would be: -0.63% (negative inflation/deflation)

- This shows how global metal prices have been keeping inflation above zero.

Why Are Online Discounts Being Reversed?

- After GST cuts, online marketplaces reduced prices by 4%.

- But 3% of this reduction has already been rolled back.

- Economists expect offline shops to start reversing price cuts too.

- This means GST-led price relief may not last long.

Implications

- The headline inflation number (25%) looks low, but does not reflect true underlying pressures.

- Once the base effect turns unfavourable, CPI inflation will rise.

- Rising gold and silver prices are artificially lifting inflation, affecting RBI’s decisions.

- GST cuts reduced inflation, but businesses are reversing discounts, limiting long-term impact.

- RBI’s MPC will now rely heavily on the core inflation trend, base effect projections, and food price outlook for policy decisions.

Challenges and Way Forward

| Challenges | Way Forward |

| Inflation appears artificially low due to base effect. | RBI must look at core inflation and forward-looking indicators. |

| Surging gold and silver prices distort headline CPI. | Consider sensitivity analysis excluding volatile items. |

| Food inflation is likely to rise as the base effect turns unfavourable. | Strengthen food supply chains and reduce volatility. |

| GST-led price cuts may not last long. | Improve monitoring of pass–through benefits to consumers. |

| Difficulty in interpreting headline CPI. | Communicate clearly about transient factors affecting inflation. |

| MPC rate cuts depend on complex data. | Use detailed modelling of base effects for next 6-12 months. |

Conclusion

India’s extremely low inflation rate in October is the result of a rare combination of a strong base effect, GST rate cuts and the distorting impact of rising gold and silver prices. However, with the base effect turning unfavourable and price reversals already beginning, inflation is expected to rise again. The RBI will have to carefully interpret these moving parts before deciding on future rate cuts.

| Ensure IAS Mains Question Q. India’s retail inflation fell to a record low in October 2025. Explain how factors such as the base effect, GST rate cuts, and rising gold and silver prices shaped the inflation number. What challenges does this pose for monetary policy? (250 words) |

| Ensure IAS Prelims Question Q. Consider the following statements regarding CPI inflation in India: 1. The base effect lowers inflation when prices in the same month of the previous year were high. 2. Gold and silver together contribute more than 5% weight in the CPI basket. 3. Food items account for around 39% of the total CPI index. Which of the above statements are correct? Answer: b) 1 and 3 only Explanation: Statement 1 is correct: The base effect reduces inflation when last year’s prices were high because the comparison base is large, mathematically pushing the current inflation rate downward. Statement 2 is incorrect: Gold and silver together form only 1.19% of the CPI basket, so their impact on inflation is limited unless price changes are extremely large. Statement 3 is correct: Food items have a weight of around 39% in the CPI, making food inflation a major driver of the overall inflation rate in India. |

Also Read | |

| UPSC Foundation Course | UPSC Daily Current Affairs |

| UPSC Monthly Magazine | CSAT Foundation Course |

| Free MCQs for UPSC Prelims | UPSC Test Series |

| Best IAS Coaching in Delhi | Our Booklist |